Day trade forex strategy system, MACD RSI and EMA free MT4 template, forex indicators.

Top YouTube videos about Forex Trading System, Stock Market Trading, and Macd Divergence mq4, Day trade forex strategy system, MACD RSI and EMA free MT4 template, forex indicators..

Visit our site https://forex4newbiesblog.blogspot.com/ Forex price action chart analysis, Forex Strategy, Forex Systems, Forex Signal, MT4 Indicators, MT4 Templates, for all traders. All materials in this blog share for free.

Affordable Windows VPS, Lightning Quick, Scalable, and Secure

https://bit.ly/BestForexVPS2021

Get the edge in Forex trading.

http://bit.ly/ForexGuideStrategy

Comprehensive and structured learning.

Learn how the Forex market really works and use this knowledge to conquer the Forex markets.

Comprehensive and structured learning

Everything you need to conquer Forex!

We provide comprehensive Forex training for beginners and advanced traders. You will learn all about Forex, master our trading strategy and can even follow our trade signals. We want to you become a Forex success.

http://bit.ly/ForexGuideStrategy

Best regards,

🙂 🙂 🙂 🙂 recommenced real live forex signals for everyone http://bit.ly/FXsignals2019

I am very happy to share “Trend Mystery”. It’s a powerful MT4 trend indicator (Not EA/Robot) that works on ALL pairs and M15, M30, H1, H4, and D1 timeframes.

“Trend Mystery” has been equipped with a unique Multi-Level

Confirmation feature, whenever a new BUY/SELL signal is generated,

it will inform you via a pop-up sound alert, email alert or a push notification sent to your mobile.

If you get a new signal, it will stay there. No repaint, highly accurate BUY/SELL signals, unique Multi-Level Confirmation feature, 3 types of signal alerts and multiple trading styles…All in just one indicator…

Get your own copy HERE ” http://bit.ly/bestindicator2019 ” right now, you will be very happy!

New…Down load my Forex Trading Strategies android app https://goo.gl/zXZZ9n

#######################

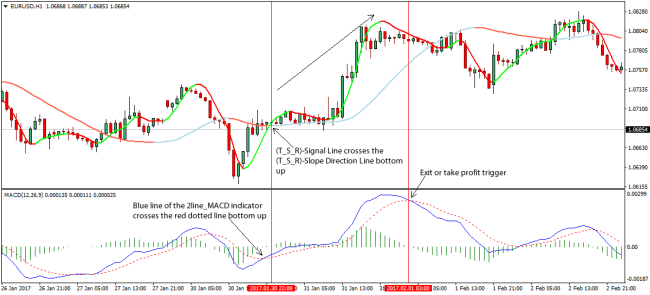

Day trade 30min time frame is a trend momentum system, it’s based on exponential moving averages.

Time frame 30 min or higher.

Currency pairs:AUD/USD, USD/JPY, EUR/USD, GBP/USD, EUR/JPY, NZD/USD, USD/CAD, GBP/JPY.

Indicators:

Exponential Moving Average 6 period, close, the color blue,

Exponential Moving Averages from 7 at 20 periods, close green,

Exponential Moving Average 21 period, close, the color red,

MACD (3, 26, 1).

RSI (10 periods) oversold 30 levels, overbought 70 levels.

Trading Rules Day Trade 30 min Time Frame

Buy

MACD above 0 lines.

RSI must be below 70 lines or above 30 lines.

The candle must be close above EMA area.

Red or blue EMA must be clear in the chart. (not covered by other ema).

Sale

MACD below 0 lines.

RSI must be below 70 lines or above 30 lines.

The candle must be close below EMA area.

Red or blue EMA must be clear in the chart. (not covered by other ema).

Exit position

You can give a take profit at 1 to 3 or 1 to 2 ratio. Initial stop loss last turning point, Or you can close a trade when candle close inside the ema area.

#F4N

#Forex4Newbies

Macd Divergence mq4, Day trade forex strategy system, MACD RSI and EMA free MT4 template, forex indicators..

Forex Leading Indicators: Exists A Real Leading Indicator?

When was the last time you really hung around with your set? Lastly you need to be able to back evaluate the lines. Aim to bank early and take your profit, when the chances are at there best.

Day trade forex strategy system, MACD RSI and EMA free MT4 template, forex indicators., Explore top complete videos about Macd Divergence mq4.

Trade Without Signs – Find Out Price Action

What ever number of lots you decide to trade – divide that into thirds. This simply goes to show you that different trading designs exist, and much of them work. Here is an example of a basic trading system.

At the same time, I think a great deal of traders attempt to under streamline too response to all the over complication. I have actually heard of traders that do not utilize any signs and just look at rate and take trades. Think me, there are some who have the experience to do that. 99.99% opportunity that you’re not one of them.

As I have actually played with these two I have actually added and subtracted other indications to match them: EMA Crossover Informs, Macd Trading, Awesome Oscillator, RSI, Stochastics, CCI – the gamut. When all the dust is settled I find they work best by themselves without all the additional noise created by additional indications.

However there is one indication, one core piece of information, that is constantly approximately date and constantly right. That piece of details, is price. And particularly the closing rate at the end of every Macd Trading signals day. All the news, inside information, financial and basic data available, is reflected because closing cost.

MACD represents “moving typical convergence/divergence”. Now that’s a mouth full. It is a visual representation of the typical price pattern of a currency pair. People include this to the bottom of their charts to help predict the trend (direction either up or down) of a currency set.

What instructions is the currency set you are Macd Trading Crossover moving? – A lot of traders think they do this however they rarely have a list of products to examine before going into. For instance, if you trade throughout the United States timespan you could examine some of the following products: Dow Futures or other equity futures, the financial news that will be exposed throughout the time you are trading, how the marketplaces were selling Asia and London the night prior to and what the marketplace is responding to at today. Your trade entry will be impacted by all of these. When you trade is important, understanding how to read the market based on.

It is inadequate simply to know the cost has struck the line of resistance and recuperated though. We ought to likewise attempt to get a sign that the strength and momentum of the market is likewise in favour with our theory. For this, we might have a slow stochastic oscillator, a MACD and a RSI just as an example to provide us an indication of the weight of our reentry into the trade or late entry based on the retracement idea.

A MACD divergence is the most popular strategy used with this indicator. It tends to be pretty consistent. When cost makes a brand-new low and the MACD line is higher than its previous low point, a bullish divergence is. This is where the “divergence” happens. The indicator’s line is relocating a various instructions than the rate. It’s diverging far from it. This creates a signal to purchase. Bearish divergence is the same concept. Rather of forecasting a buy point, it informs you that the present up-trend is pertaining to an end. This is a great location to exit a trade.

So there you are. It sounds easy when looked at from this high level summary. The reality is though, that it’s really difficult. The data of failed traders plainly show that. Success takes an extended period of time. Whether you connect to my view of the marketplaces, or choose some other technique of defining market structure, spend a great deal of time simply seeing rate motion. Find out to ‘check out the tape’ as it used to be called, internalizing the patterns and flow of movement of rate. It takes time. Be patient, and embrace the challenge.

MACD is one of the most postponed indicators indeed but it is different from all the other indicators. Attempting to anticipate the bottom is more like gaming than trading. Trend traders never repair an earnings target.

If you are finding updated and exciting reviews related to Macd Divergence mq4, and Trade Forex, Trend Analysis, Trend Timers, Complex Indicators you are requested to list your email address for email subscription DB now.