DIVERGENCE MACD | TUTORIEL TRADING

Trending full length videos related to Foreign Currency, Hair Removal, Trading Success, Trading Stocks, and What Is Divergence in Macd, DIVERGENCE MACD | TUTORIEL TRADING.

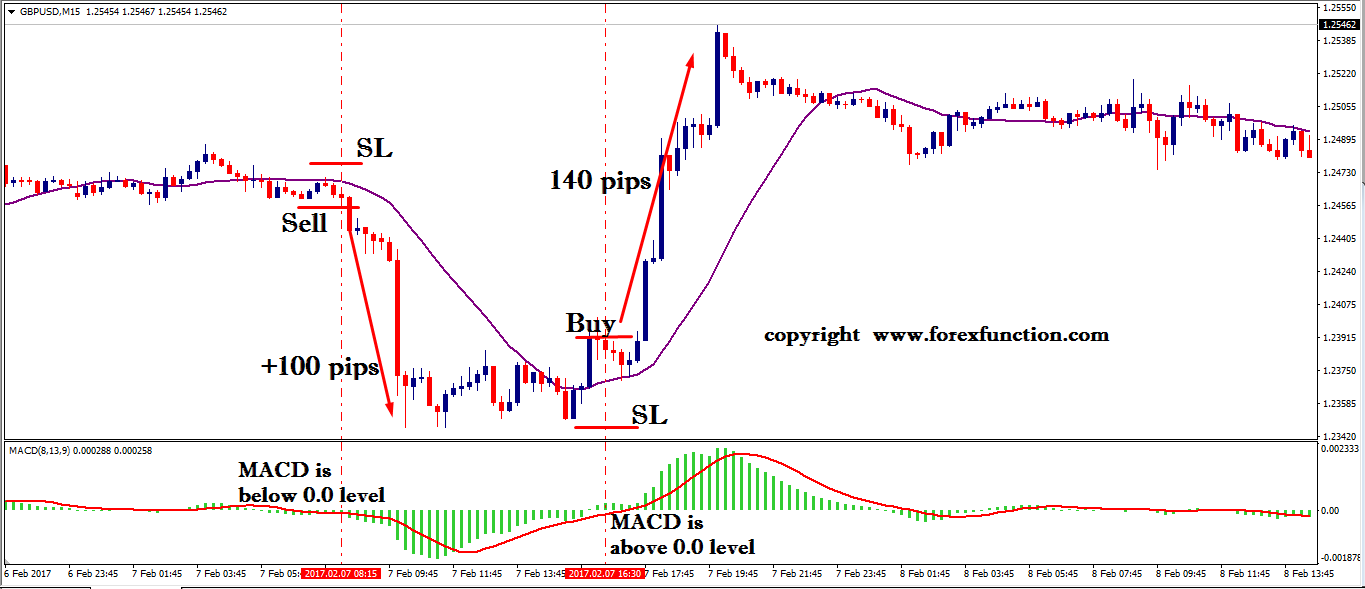

Qu’est-ce que c’est une divergence MACD et comment trader en base de ces signaux. Dans cette nouvelle vidéo de la série tutoriels de trading on va approfondir avec des exemples pratiques.

Vidéo inspirée des explications de LucJean, trader pro (merci à toi)

…..…..

Liens

…..…..

Groupe Telegram publique (francophone):

https://t.me/SergioICO_FR

Groupe Telegram publique (anglophone):

https://t.me/SergioICOReport

Groupe d’annonces (anglophone):

https://t.me/SergioICOReport_ANN

Notations des projets ICO

http://spreadsheet.sergioico.com

Concours de révision de projethttp://listing.sergioico.com

Suis-moi sur Twitter

Tweets by sergiogarciafer

…..…..…..…..…..…..…..…..…..…..…..…..…..…..

NOTE IMPORTANTE: L’auteur de cette chaîne n’est pas conseiller financier et le contenu n’est pas du conseil financier, mais simplement produit à titre informatif et ludique. Faites toujours vos recherches avant d’investir votre argent et ne dépensez pas plus de ce que vous pouvez vous permettre de perdre.

…..…..…..…..…..…..…..…..…..…..…..…..…..…..

What Is Divergence in Macd, DIVERGENCE MACD | TUTORIEL TRADING.

Rate Action – Why It’s The Ultimate Forex Trading Technique

Some traders execute a number of trades and make earnings with ease. Wait for it to swing to the opposite side of the 0 line and after that both main and signal lines to return back. Here is an example of a standard trading system.

DIVERGENCE MACD | TUTORIEL TRADING, Find latest reviews related to What Is Divergence in Macd.

How To Trade The Forex Market Without Signs?

Utilizing the ideal combination of indicators can help you paint of photo of where rate is heading. An excellent trade is one entered and left based upon guidelines and conditions – no matter the outcome.

The traders biggest trading tool is the system or method he adopts everyday to traverse this multifaceted market. The trading system simply informs him when to enter the marketplace (Buy and Offer a currency set). The buy and sell chances are concerned as trading signals. They represents the principles of which automated trading soft wares widely called FX Robots works. There are many articles that offers Forex trading system or Robots, however have not seen lots of that teach you on how you can develop and develop your own trading system that will assist you capture the moves in the marketplace.

As I’ve played with these two I’ve added and subtracted other indicators to match them: EMA Crossover Notifies, Macd Trading, Awesome Oscillator, RSI, Stochastics, CCI – the gamut. When all the dust is settled I find they work best by themselves without all the extra noise developed by additional indicators.

A number of these indications are excellent and do, in reality, offer traders a better manage on cost action. However how good are they in assisting you make stock Macd Trading signals decisions?

MACD represents “moving average convergence/divergence”. Now that’s a mouth full. It is a visual representation of the average rate pattern of a currency pair. Individuals add this to the bottom of their charts to help forecast the trend (direction either up or down) of a currency pair.

With your newly created Macd Trading Crossover formula, let us see it in action. Utilize your favorite paper trading software, determine trading chances that fit your technique, and place your trades diligently.

Moreover, there are a great deal of trading tools and indicators such as EMA (Rapid Moving Typical), SMA (Easy Moving Average), MACD and others. But one can not always depend on the tools to get the fastest forex signals.

MACD is one of the most postponed indications certainly but it is various from all the other indicators. Considering that I found the power of MACD, I never eliminated it from my charts. MACD is a fantastic indication and if you speak with it in your trades, you earn less mistakes.

Similarly, if you discover a currency set trading above the 20 day EMA and the 100 day SMA. Wait on this currency set to start trading listed below the 20 day EMA and the 100 day SMA. Participate in a short trade if the MACD turns unfavorable no greater than 5 candle lights back. Place the stop loss at the high of the candle light that broke the moving averages. Take profit on half of the position when the currency set has moved in favor of the trade by the quantity ran the risk of and move the stop for the remainder of the position to recover cost. Trial the stop for the rest of the position with 20 day EMA plus 15 pips!

What that means is that you should see MACD in the exact same area as the pattern. This is necessary as one unfavorable concern in trading Forex is losses. Then 15 minutes after the (FA) news, you might trade.

If you are searching best ever entertaining comparisons about What Is Divergence in Macd, and Automatic Forex Trading Software, Manage Forex please subscribe for email list for free.