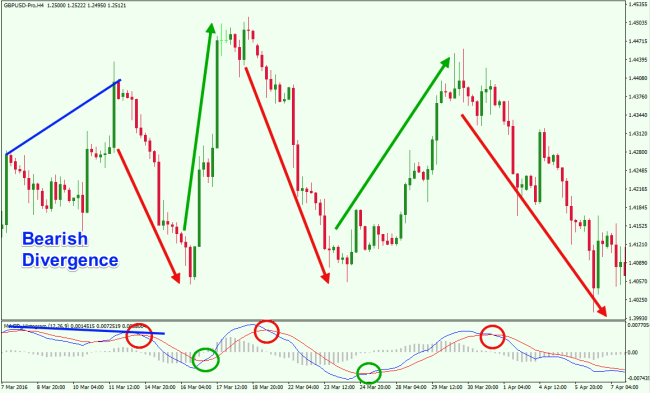

Example 2 – Use Trend Filter and RSI Divergence to find strong candidate

Best vids about Foreign Currency, Hair Removal, Trading Success, Trading Stocks, and How to Scan for Macd Divergence, Example 2 – Use Trend Filter and RSI Divergence to find strong candidate.

In this video tutorial, we are going to show you guys an example of how to find strong stocks candidate by using a combination of trend filters and indicator filters:

Daily Chart is in up trend

Weekly Chart is in up trend

Monthly Chart is in up trend

Daily RSI (14, 30,70) is not over bought

Weekly RSI (14, 30, 70) is not over bought

Monthly RSI (14, 30, 70) is not over bought

RSI indicator IsBearishPeaksDivergence is FALSE

With these settings to scan a market and finally we will review some of the market scan results and estimate the performance of this set of settings.

Hope the content of this video tutorial is useful for you.

How to Scan for Macd Divergence, Example 2 – Use Trend Filter and RSI Divergence to find strong candidate.

Rate Action Forex Trading And How You Can Benefit

In spite of the benefits currency trading software can supply, you must not rely too heavily on them. Moving averages are one of the most popular indications used by traders to recognize a trend.

Example 2 – Use Trend Filter and RSI Divergence to find strong candidate, Get more updated videos relevant with How to Scan for Macd Divergence.

Forex Scalping Without The Usage Of Indicators

No one, not even trend traders, knew that Nortel would reach less than 50 cents a share. By the time you read this the trading activity which we’re talking about will have currently happened.

When you learn more about forex trading there are numerous technical tools to master, however among the easiest to utilize is the pivot point. Pivot points deal with assistance and resistance levels to provide you a sign of entry and exit points for your foreign exchange trades.

A few of the stock signals traders take a look at are: volume, moving averages, Macd Trading, and the stochastic. They also need to look for floorings and ceilings in a stock chart. This can reveal a trader about where to get in and about where to go out. I say “about” due to the fact that it is pretty hard to guess an “specific” bottom or an “precise” top. That is why locking in revenues is so so important. If you don’t lock in earnings you are actually running the risk of making an useless trade. Some traders end up being really greedy and it only harms them.

The range from the top of the channel to the bottom must represent a variety enough to be traded. Personally, I try to find a variety of about forty pips from leading to bottom. If the variety Macd Trading signals is less than forty pips I await the breakout trade. A basic entry method would be to cost the top and to purchase the bottom using extremely tight stops. However the smallest little bit of market noise could stop out my trade before it has a chance to work.

Writing assists us connect with what is hidden from us, offering us responses to those concerns that seem to baffle us frequently exposing the reason behind our anger.

Most signs that you will discover in your charting software application come from among these 2 classifications: You have either indications for determining patterns (e.g. Moving Averages) or indications that define overbought or oversold scenarios and Macd Trading Crossover for that reason provide you a trade setup for a brief term swing trade.

The MACD is an acronym for Moving Average Convergence/Divergence. It is a pattern following momentum indicator that shows the relationship between two moving averages of rates. The MACD default is the distinction between a 12-day and 26-day rapid moving average. A 9-day rapid moving average, called the signal or trigger line is outlined on top of the MACD to show buy/sell opportunities.

Due to the fact that it’s the easy system that works in this ever-changing brutal currency market, I have actually always kept my trading systems simple. Shocked by that? Did you believe that an effective trading system needs to be sophisticated and difficult to use? Succeeding from the forex market depends on how efficiently the trader himself utilizes the trading system and not how excellent the trading system is.

Swing trading in Forex is very simple but its a very efficient way, to make huge Forex gains and due to the fact that humanity, will constantly press rates to far to the benefit or drawback when greed and worry take hold, it will always work. Attempt Forex swing trading if you want to make terrific profits from currency trading in 30 minutes a day or less.

You can use Bollinger bands, moving average bounces, MACD crossovers and many other kinds of systems. That guru will not be the one to position the trade for you. The higher the revenue element the much better the day trading system.

If you are finding updated and exciting reviews about How to Scan for Macd Divergence, and Best Forex Strategy for Forex Trading, Forex Charts, Online Dating, Momentum Forex Trading you are requested to join our email list for free.