How to build, test & optimize an MACD trading trading strategy over multiple crypto pairs

Best YouTube videos related to Share Trading, New Technical Traders, Forex Markets, Why Use Technical Indicators?, and MACD Crossover Near Zero Line, How to build, test & optimize an MACD trading trading strategy over multiple crypto pairs.

In this snippet from our webinar for FTX traders, we demonstrate how to test & optimize an MACD trading strategy and compare its performance over a group of crypto assets.

Watch and learn how easy it is to create, backtest, monitor & execute fully automated trading strategies using zero-coding.

Plan like a human. Trade like a machine: https://bit.ly/2YTjlI6

MACD Crossover Near Zero Line, How to build, test & optimize an MACD trading trading strategy over multiple crypto pairs.

Does The Holy Grail In Forex In Fact Exist?

Quietly closing and opening trade, making you cash and letting you get on with the essential things in life. Do not invest money than you can not manage to lose. That’s why you may need some help from the Forex Auto-pilot system.

How to build, test & optimize an MACD trading trading strategy over multiple crypto pairs, Explore new reviews relevant with MACD Crossover Near Zero Line.

A Forex Trading Tutorial On Losing Your Indicators

It isn’t like when 2 moving averages cross each other and you are “expected” to buy. it doesn’t work like that. To succeed you require to learn foreign currency trading online that you can apply fast wise.

At the exact same time, I think a great deal of traders attempt to under simplify too reaction to all the over complication. I have actually become aware of traders that do not use any signs and simply look at rate and take trades. Think me, there are some who have the experience to do that. 99.99% chance that you’re not one of them.

When you truly stop and think about it, what do you think your brand-new good friend’s response is going to be if when you satisfy Macd Trading for the first time it’s obvious you’re not the individual they believed they were going to be conference? “Oh. hi. I see that you’ve been unethical with me from the outset here, however hey, I’m still thinking we’ve got a terrific chance at having an open, relying on relationship for the long-lasting” Clearly not.

Set a target above the key level of assistance you see and bank your earnings Macd Trading signals just above this level, do not await the level to be hit because, if you hang on to long you run the risk of a relocation back up which will consume into your earnings. Look to bank early and take your profit, when the odds are at there finest.

Many lucrative day trading systems attain a good net revenue with a rather little winning percentage, in some cases even below 30%. These systems follow the principle “Cut your losses short and let your profits run”. Nevertheless, YOU need to decide whether you can stand 7 losers and just 3 winners in 10 trades. If you want to be “right” the majority of the time, then you must pick a system with a high winning percentage.

Discover the alternative or stock that you plan to trade. On choices, preferably find one with a. 70 delta or greater. Front month is OK however Macd Trading Crossover you must exit the very same day or your risk is much greater.

So you have a MACD indicator on your chart. When it increases to overbought area it offers you a buy signal. However it also provides numerous countless other traders a buy signal. You all buy the stock anticipating it to increase.

What you wish to do is want for “backtrack and resume”. What that suggests is that you need to see MACD in the same area as the trend. Await it to swing to the opposite side of the 0 line and then both main and signal lines to return back.

In our trading group, a few of our traders have actually been using this strategy very effectively. This is a longer term trade, typically lasting a week or more, and takes patience to establish, perseverance while in the trade, and understanding when to leave the trade. The charts are there to help you. Happy trading.

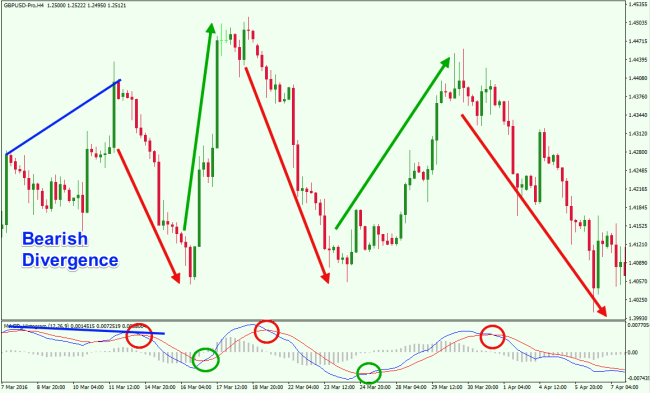

Momentum indicators are easy to discover and will inform you, if the market is overbought in visual form. Sometimes the distinction can be as high as 75%. This is the 2nd details that we can learn from divergences.

If you are finding exclusive entertaining comparisons related to MACD Crossover Near Zero Line, and Efficient Forex Strategy, Currency Trading, Waxing Hair Removal dont forget to signup in a valuable complementary news alert service totally free.