How to Calculate MACD in Excel

Popular updated videos highly rated Trading Info, Cause of Hair Loss in Women, Forex Trading Indicators, and How To Calculate MACD Crossover, How to Calculate MACD in Excel.

This guy (Stock Stuffs) deleted his channel for whatever reason.

I found this video incredibly helpful for programing purposes.

How To Calculate MACD Crossover, How to Calculate MACD in Excel.

Forex Leading Signs: Exists A Real Leading Sign?

OWhen you choose a smaller sized timeframes (less than 60min) your average revenue per trade is normally comparably low. Personally, I search for a variety of about forty pips from leading to bottom.

How to Calculate MACD in Excel, Play more explained videos relevant with How To Calculate MACD Crossover.

Trading Ideas – When To Purchase Or Sell

I try to go with the trend and identify the course of least resistance is where I want to be. However how excellent are they in assisting you make stock trading decisions? This article was composed at around midnight, March 24, 2006.

When you discover about forex trading there are numerous technical tools to master, however one of the easiest to use is the pivot point. Pivot points deal with assistance and resistance levels to offer you a sign of entry and exit points for your foreign exchange trades.

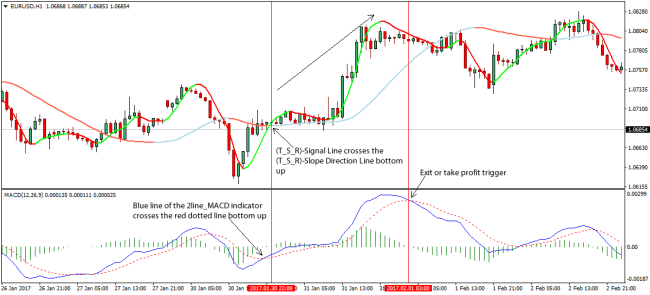

CROSSOVERS: The standard Macd Trading rule is to offer when the MACD falls listed below its signal line. While a buy signal happens when the MACD increases above its signal line. When the MACD goes above or below no line, it is also popular to buy or offer.

So, can one currency set make sufficient cash for you to make a living Macd Trading signals currencies? Negative Turnaround signals (a character tool of RSI) have actually produced over 25,000 pips in 2010. That should do it and if that isn’t enough, Favorable Reversals produced 15,000 pips.

Numerous rewarding day trading systems attain a good net revenue with a rather small winning portion, in some cases even below 30%. These systems follow the principle “Cut your losses short and let your revenues run”. Nevertheless, YOU require to choose whether you can stand 7 losers and only 3 winners in 10 trades. If you want to be “ideal” the majority of the time, then you ought to select a system with a high winning percentage.

Most indicators that you will discover in your charting software belong to among these 2 classifications: You have either indications for identifying trends (e.g. Moving Averages) or indications that specify overbought or oversold situations and Macd Trading Crossover therefore provide you a trade setup for a short term swing trade.

The MACD is an acronym for Moving Typical Convergence/Divergence. It is a trend following momentum sign that shows the relationship in between 2 moving averages of prices. The MACD default is the difference between a 12-day and 26-day rapid moving average. A 9-day rapid moving average, called the signal or trigger line is plotted on top of the MACD to reveal buy/sell chances.

Observe the MACD. , if the MACD turns positive enter into a long trade within 5 candles of it turning positive.. You must place the stop loss at the low of the candle that was the first above the two moving averages.

Even with this checklist in mind, it is necessary to bear in mind that nothing is specific. There are no warranties in Forex, so run the risk of management is key. Be a “Forex snob” and wait the trade set up to satisfy whatever criterion you have decided to use, every time.

In our trading group, some of our traders have actually been utilizing this technique very successfully. It appears all over you go, individuals are simply selling these forex trading systems in a box.

If you are looking unique and exciting comparisons about How To Calculate MACD Crossover, and Forex Alerts, Mistakes of New Technical Traders you are requested to list your email address our newsletter totally free.