How To Filter Out RSI Indicator Fake Signals

Popular YouTube videos highly rated Forex Broker, Stock Market Trading, Forex Buy Sell Signals, and Avoid Macd False Signals, How To Filter Out RSI Indicator Fake Signals.

Using the RSI Filter. http://www.financial-spread-betting.com/strategies/day-traders.html PLEASE LIKE AND SHARE THIS VIDEO SO WE CAN DO MORE! In this lesson, we are continuing looking at using filters on the price chart in order to avoid trades that may not be optimal. Again, these are filters to prevent, or at least advise, us not to enter trades when the conditions are not so favourable. They do not necessarily tell us when the trade is a good idea, simply when it’s not a good idea. If you use filters in this way, it can help to reduce the number of bad trades that you make, and increasing the percentage of winning trades will result in more profit.

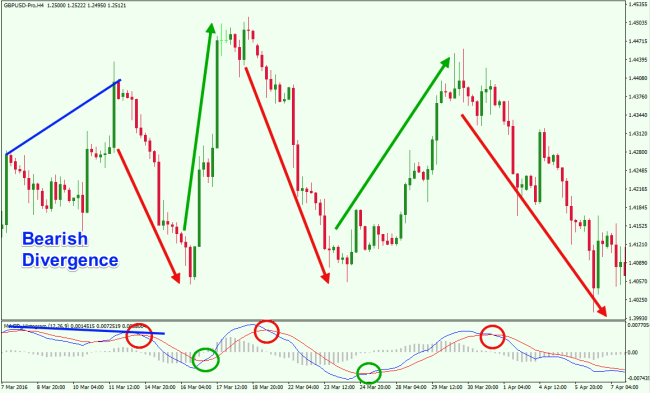

This time we look at using the RSI indicator as a filter. This is the Relative Strength Index which gives some indication of the strength of a financial security relative to itself. It’s in the family of indicators that are called oscillators and usually mapped out below the price chart with a range that goes from 0 to 100%. Other oscillators such as the stochastic could be used instead.

The idea of an oscillator is that its value usually goes between 30% and 70%, or sometimes 25% to 75%, and when it goes outside these bounds it indicates that the stock is overbought or oversold. Having said that, in a trend you may find that the oscillator stays outside these bounds while the trend continues, so in itself being outside the normal range is not a reason to enter a long or short trade.

But the way we are using the oscillator this time is as a filter, and that is to make us hesitate before going into a trade where the elements are not all aligned. It’s to keep from getting involved in a chart where everything isn’t in our favour. So regardless of how much we may think we want to take a long trade, if the oscillator is above say 70% it would not be a good time to do so.

Similarly, although we wouldn’t necessarily use the RSI as a trigger for a trade to happen, we can take a low value of RSI as allowing us to place a trade. If the trend is a strong uptrend, it’s unlikely that the value will come down as far as 25%, but we can at least look for the value to be down to say 45% before we contemplate taking a long trade. Depending on our trading plan, if it goes lower on a retracement in what is otherwise a strong uptrend we may decide we definitely want to become involved.

Using a filter to decide when not to trade will almost inevitably mean that you are making fewer trades. Some of those trades you may look back on as missed opportunities, particularly if they work out as you thought they might. But what we want to concentrate on is increasing the probability of good trades, and that means eliminating suspect trades, those that may tend to work out less often than others. By using the various filters explained here, you should keep down the number of bad trades that you suffer.

Related Videos

The Stochastic Indicator: When it Works, When it Doesn’t & Why – Part 1 📈

Stochastics Trading Strategy Part 2 📈

How to Profit from using the RSI (Relative Strength Index)? Part 1 📈

RSI Indicator Trading Strategy Part 2 📈

How To Filter Out RSI Indicator Fake Signals

Multi Time Frame Analysis With Oscillators

https://www.youtube.com/watch?v=KXDQ-QR3cco

Avoid Macd False Signals, How To Filter Out RSI Indicator Fake Signals.

Pointers On Learning Forex Forecasts

I exposed an essential secret in the previous edition of SDE on the very best trading time for the EMA 4/12/63.

This is a longer term strategy that typically takes from one to 2 weeks to exercise.

How To Filter Out RSI Indicator Fake Signals, Get latest complete videos related to Avoid Macd False Signals.

Price Action – Why It’s The Supreme Forex Trading Technique

Swing traders leave a trade open for days and after that position traders, the long term traders, who open a trade for weeks. Technical Analysis utilizes historic prices and volume patterns to anticipate future habits.

Has your trading 4x online come to a grinding halt? Do you get in a trade and simply have it reverse and take you out at a loss? Have you ever desired a strategy that corresponded in earning money and you didn’t need to watch it minute by minute? I have something here that may just work for you. This short article presumes that you have some knowledge on online forex charting utilizing technical studies especially; the Exponential Moving Average, MACD, and Stochastics. For my charting requirements I use Wizetrade Forex and the totally free technical charts from MB Trading.

Day trading is for those who understand how to trade and have a technique they stay with. It is specifically crucial to stick to the strategy that is made. This is necessary as one unfavorable issue in Macd Trading Forex is losses. Every trader will deal with losses and have to accept them and deal with them. When they deal with more than one loss, they likewise have to have the self-control to follow the method that is made. If there are 2 losses successively, the strategy might be that the trading day ends.

When confronted with numerous alternatives, the majority of clients have trouble making a clear decision. They often respond by putting things off – and never making a choice. Macd Trading signals When this takes place, you lose a sale you currently had.

Using RSI we will have tools that will help us understand the currencies personality such as RSI Range, RSI Variety Shifts, Momentum 1 and 2 and the 4 RSI Trading Signals. All of these strategies can be used to be familiar with a particular currency set like it was your friend.

With your recently produced Macd Trading Crossover formula, let us see it in action. Utilize your preferred paper trading software application, determine trading opportunities that fit your technique, and position your trades vigilantly.

Fears we have actually not dealt with or welcomed. * Hurt sensations that either are not recognized or dealt with. * Blocks or blockages that keep us from attaining our objectives, progressing, or establishing self-confidence. * Lost dreams due to overwhelm. * Feelings of isolation. * Frustration * Negativity and judgments. * Not able to focus.

Now this is the most vital stage and my trading decision lies here. I utilize the crossing of 4 EMA (Rapid Moving Typical) and 23 EMA to specify purchase and offer signals on the 30 minute chart. There are other indicators involved, the weekly pivot, Stochastic and MACD (Moving Average Merging Divergence) should likewise follow the pattern and can not look flat. I filter whipsaws by trading just during high liquidity sessions and inspecting whether the trend is the very same utilizing 4 hourly chart. That’s all!

Always confirm the trading signals given by the histogram with the price action. It suggests the rate action will continue to move in the very same instructions if the rates and the pie chart make new lows or new highs together.

Ultimately you need to do what you feel comfy with. You just have to have the ability to recognize which method it is going. If the system doesn’t utilize the MACD, that doesn’t suggest you can’t “fine-tune” it a bit by including it.

If you are finding unique and entertaining comparisons relevant with Avoid Macd False Signals, and Market Cycles, Best Forex Indicators, Hair Loss dont forget to list your email address for a valuable complementary news alert service for free.