How to Find Stocks Before They EXPLODE 🔥 (FINVIZ.com for Day Trading)

Interesting vids about Forex Currency Trading, Internet Marketing, and How To Screen For MACD Crossover, How to Find Stocks Before They EXPLODE 🔥 (FINVIZ.com for Day Trading).

I made this video showing how I find stocks before they go on very large runs and how I use Finviz.com to find these stocks before they go up. Possibly the best screener / scanner for day trading.

Scanner: https://finviz.com/

Instagram: https://www.instagram.com/ylin.vest/

Discord (currently at 1300 members): discord.gg/FZKZ63h

How To Screen For MACD Crossover, How to Find Stocks Before They EXPLODE 🔥 (FINVIZ.com for Day Trading).

The Brutally Honest Fact About The “Best” Forex Trading Indicators

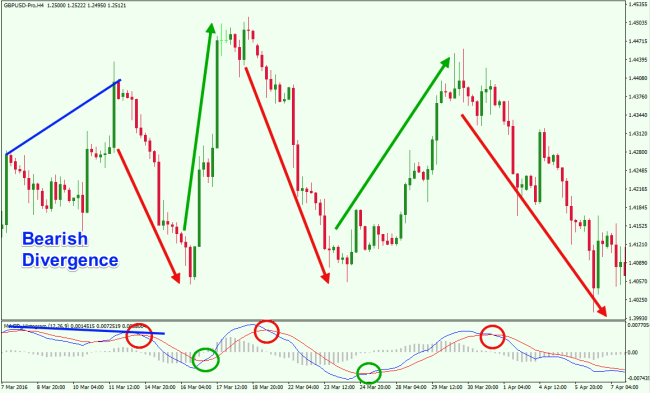

The more commonly used value of MACD is (12, 26, 9). This is very easy to do with a Forex currency trading system. Look at the optimum drawdown the system produced so far, and double it.

How to Find Stocks Before They EXPLODE 🔥 (FINVIZ.com for Day Trading), Get more high definition online streaming videos related to How To Screen For MACD Crossover.

Currency Trading Techniques – 2 Methods Of Trading That Wealthy Home Traders Use

You require to practice this for many hours up until you get constant at selecting winning trades. That’s $200 dollars a day, $1,000 a week and $4,000 a month. At times they signal a market reversal to the day.

I have constantly preferred technical to essential analysis in my choices for trading financial markets. I see a great deal of manipulation in markets today, and for that reason I do not trust my basic understanding to give me precise signals where to exit the market and enter and how to interpret this or that piece of macroeconomic news. When I have to do it extremely quickly, numerous technical analysis tools assist me to define levels for entries and exits and make it easier to make options. I desire to speak about the tools in the article.

I have actually constantly stated that it is not about market knowledge or technical indications. A great trader discovers how to control his/her feelings by establishing a tailored Macd Trading strategy. A good trade is one entered and left based upon conditions and guidelines – regardless of the outcome. Up until a trader discovers how to manage their emotions and make sound trading choices based on guidelines, they are doomed to make the exact same portfolio killing decisions of follow the most recent master. There is no success there. That master will not be the one to put the trade for you. You MUST discover how to pull the trigger yourself.

Experience holds the key. Reading a lot of books on technical analysis assists to narrow the list down. You quickly no Macd Trading signals in on the handful that keep coming up again and again in book after book.

What you want to discover is times when there are three successive Heiken Ashi candle lights amongst ALL FOUR pairs that are in contract. and in the very same direction.

Price – I personally think cost action (I utilize japanese candle patterns) in addition to moving average and assistance and resistance. I attempt Macd Trading Crossover to choose the pattern and determine the course of least resistance is where I wish to be.

Trade “A” – Using the MACD on a day-to-day chart, trading 1 currency set, and every time he notifications the lines are crossing he takes the trade. This trader will make a minimum of 25 to 50 trades by the end of the month. He will have some losers and winners, but we will provide him the advantage of the doubt and claim that he made a 250 pips for the month. I guarantee you that this trader will remain in the unfavorable after 3 months.

A MACD divergence is the most popular technique used with this sign. It tends to be quite consistent. A bullish divergence is when cost makes a brand-new low and the MACD line is higher than its previous low point. This is where the “divergence” takes place. The sign’s line is relocating a different direction than the price. It’s diverging far from it. This creates a signal to purchase. Bearish divergence is the exact same idea. Rather of anticipating a buy point, it tells you that the present up-trend is coming to an end. This is a good place to exit a trade.

In our trading group, some of our traders have been utilizing this method very effectively. This is a longer term trade, typically lasting a week or more, and takes perseverance to develop, perseverance while in the trade, and understanding when to exit the trade. The charts are there to help you. Pleased trading.

Currency trading takes place round the clock and round the year. Using a signal supplier a couple of years back I learned this staggered method. People make money with signs, and people lose cash with them.

If you are looking instant engaging videos related to How To Screen For MACD Crossover, and Market Cycles, Currency Trading Training please list your email address our subscribers database now.