How To Trade Moving Average,RSI, Stochastics, MACD, Bollinger Bands Forex Trading Strategies

Latest replays relevant with Stock Signals, Currency Trading, Trading Rate, Forex Seminar, and How to Avoid Macd False Signals, How To Trade Moving Average,RSI, Stochastics, MACD, Bollinger Bands Forex Trading Strategies.

How To Trade Moving Average,RSI, Stochastics, MACD, Bollinger Bands Forex Trading Strategies

\\\\\\\\\\\\\\\\\

BASIC INDICATORS – RSI,STOCHASTICS,MACD AND BOLLINGER BANDS

RELATIVE STRENGTH INDEX (RSI):

Developed J. thespian Wilder, the Relative Strength Index (RSI) may be a momentum generator that measures the speed and alter of value movements. RSI oscillates between zero and one hundred. historically, and in step with Wilder, RSI is taken into account overbought once higher than seventy and oversold once below thirty. Signals may be generated by searching for divergences, failure swings and line crossovers. RSI may be accustomed establish the overall trend.

RSI is taken into account overbought once higher than seventy and oversold once below thirty. These ancient levels may be adjusted to raised work the safety or analytical necessities. Raising overbought to eighty or lowering oversold to twenty can cut back the amount of overbought/oversold readings. short-run traders typically use 2-period RSI to seem for overbought readings higher than eighty and oversold readings below twenty.

STOCHASTICS

Developed by patron saint C. Lane within the late Nineteen Fifties, the random generator may be a momentum indicator that shows the placement of the shut relative to the poker game vary over a group range of periods. in step with Associate in Nursing interview with Lane, the random generator “doesn’t follow value, it does not follow volume or something like that. It follows the speed or the momentum of value. As a rule, the momentum changes direction before value.” As such, optimistic and pessimistic divergences within the random generator will be accustomed presage reversals. This was the primary, and most significant, signal that Lane known. Lane additionally used this generator to spot bull and bear set-ups to anticipate a future reversal. as a result of the random generator is vary sure, is additionally helpful for characteristic overbought and oversold levels

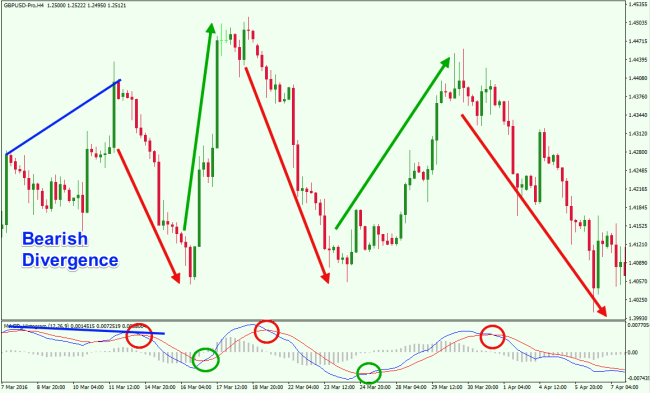

MOVING AVERAGE CONVERGENCE DIVERGENCE INDICATOR

Developed by Gerald Appel within the late seventies, the Moving Average Convergence-Divergence (MACD) indicator is one among the only and best momentum indicators accessible. The MACD turns 2 trend-following indicators, moving averages, into a momentum generator by subtracting the longer moving average from the shorter moving average. As a result, the MACD offers the most effective of each worlds: trend following and momentum. The MACD fluctuates higher than and below the zero line because the moving averages converge, cross and diverge. Traders will explore for signal line crossovers, line crossovers and divergences to come up with signals. as a result of the MACD is infinite, it’s not significantly helpful for characteristic overbought and oversold levels.

BOLLINGER BANDS

Developed by John Bollinger, Bollinger Bands square measure volatility bands placed higher than and below a moving average. Volatility is predicated on the quality deviation, that changes a volatility increase and reduces. The bands mechanically widen once volatility will increase and slender once volatility decreases. This dynamic nature of Bollinger Bands additionally suggests that they’ll be used on totally different securities with the quality settings. For signals, Bollinger Bands will be accustomed establish M-Tops and W-Bottoms or to work out the strength of the trend. Signals derived from narrowing information measure square measure mentioned within the chart college article on information measure.

How to Avoid Macd False Signals, How To Trade Moving Average,RSI, Stochastics, MACD, Bollinger Bands Forex Trading Strategies.

Actual Time Forex Charts – The Friendly Tool Required By Traders To Succeed

If your very first internet efforts haven’t shown up “the perfect one,” do not misery. There are great deal of different methods and methods for trading the Forex markets. That is why locking in earnings is so so important.

How To Trade Moving Average,RSI, Stochastics, MACD, Bollinger Bands Forex Trading Strategies, Enjoy interesting high definition online streaming videos relevant with How to Avoid Macd False Signals.

Which Forex Trading Technique To Utilize?

The technical analysis needs to also be identified by the Forex trader. The distinction between the day trader and the position trader. The upper and lower limit needs to be clear in the trade.

Although hindsight is 20/20, there’s still a lot to be learned by looking back at Forex trading. This post was composed at around midnight, March 24, 2006. By the time you read this the trading activity which we’re talking about will have already occurred.

I specify all significant support and resistance based upon a greater timeframe, and then seek to benefit from movement in between these locations on a smaller Macd Trading timeframe.

Everyone buying the stock pushes it up so supply will satisfy need. When the Macd Trading signals gives you a sell signal everybody who utilizes a MACD sees it too. They all offer causing the price of the stock to come down so need will meet supply.

Stochastics indicator has actually got two lines referred to as %K and %D. Both these lines are plotted on the horizontal axis for a given period. The vertical axis is plotted on a scale from 0% to 100%.

4) Trading Schedule. When do you prepare to trade? When will you accept brand-new entries or exits? Is there a point when all trades will be closed? Particular times of day are much better than others depending upon the Macd Trading Crossover system you are preparing. A schedule also helps you manage your life and put your concerns in appropriate order.

However not trend traders. The trend is up, you opt for the pattern. “Price” has actually dictated the instructions of this trade in apparent terms. It was a buy at $15, $25, even a buy at $80.

Technical experts attempt to spot a pattern, and ride that pattern until the trend has verified a reversal. If a good company’s stock remains in a drop according to its chart, a trader or financier using Technical Analysis will not buy the stock till its trend has actually reversed and it has been validated according to other essential technical signs.

In our trading group, some of our traders have actually been using this method very successfully. This is a longer term trade, typically lasting a week or two, and takes perseverance to establish, persistence while in the trade, and understanding when to exit the trade. The charts exist to assist you. Happy trading.

There are a lot of forex indicators based upon pattern. Even with this list in mind, it is important to keep in mind that nothing is particular. In fact, people were purchasing at $60, $40, $20, $10.

If you are looking most engaging reviews related to How to Avoid Macd False Signals, and Cycle Analysis, Forex Website, Free Forex System, New Technical Traders dont forget to join our email subscription DB now.