How to trade the MACD. Testing a strategy from TRADING RUSH

Trending complete video relevant with Foreign Currency, Hair Removal, Trading Success, Trading Stocks, and How To Trade MACD Crossover, How to trade the MACD. Testing a strategy from TRADING RUSH.

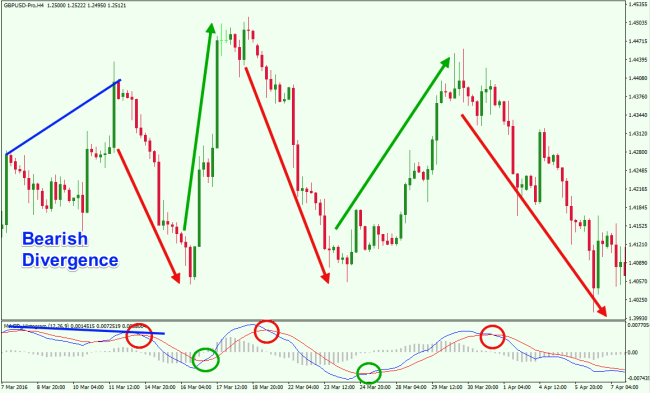

Wow. I came a across a video by Trading Rush putting the MACD to the test. So I decided to try and replicate his results. I back tested his strategy over a 2 month period and I was blown away by the results.

If you have ever wondered how to trade the MACD or how to become profitable in forex, then this strategy could be for you.

This video is far from a comprehensive review of the MACD so please do your own testing.

A link to Trading Rush’s video:

My preferred broker:

– Pepperstone

Best way to practice forex trading:

– https://forexsimulator.com/

My favourite EA’s (use with caution):

– Forex Flex EA – http://forexflexea.com/membership/aff/go/newrules

– Grid Trend Multiplier EA – https://gridtrendmultiplier.com/grid-trend-multiplier-forex-videos/

This channel is about learning to trade. I plan to learn all about risk management, trading strategies, and indicators. So that I can become profitable and hence teach you to become profitable. Some of my links will be affiliate links, but I will only share what I personally use. Otherwise i will be making no money out of this channel but instead will be making it from my forex trading.

i plan to teach how to use indicators such as the MACD, RSI and other oscillators. i have a tendency to trade forex with a naked chart and I’m a huge fan of support and resistance.

I do use expert advisor’s in my trading. I have ea’s to be very helpful and they have made me a lot of money over the years. I will share those I find most useful.

How To Trade MACD Crossover, How to trade the MACD. Testing a strategy from TRADING RUSH.

Fibonacci Forex Trading – How Anybody Can Trade Forex Successfully

Whereas, cost action has been proven to be an effective technique to earn money.

The risky period are the times at which the cost is changing and tough to predict.

How to trade the MACD. Testing a strategy from TRADING RUSH, Explore more videos related to How To Trade MACD Crossover.

Trade Without Indications – Find Out Cost Action

Make sure a trend identifying forex strategy becomes part of your arsenal. Some only trade part-time, get a big win and off they opt for a couple of weeks or months in the sun. I’ll examine a couple of popular methods to utilize it.

Automatic forex trading software application (or you may understand them as forex trading robotics) are designed to let you sit while they monitor and trade the forex markets. Silently opening and closing trade, making you money and letting you get on with the important things in life. Sounds too great to be true? Not really.

General uptrend and basic downtrend-Before investing or Macd Trading this is the most crucial indication. “The trend is your friend”. It is simpler to make money when a stock is going up, greater highs and higher lows, called an uptrend, then when it is decreasing, lower highs and lower lows, a sag. In an uptrend each brand-new peak that is formed is greater than the previous ones. If the next low is lower than the previous low the stock stops working to form a brand-new peak higher than its previous ones, the pattern will be broken. Stocks that have charts that fluctuate with no direction, and no clear uptrend or drop are difficult to anticipate which instructions they are heading. A stock in a steady general uptrend or general downtrend are much easier to trade.

But there is one indication, one core piece of details, that is constantly up to date and constantly proper. That piece of information, is cost. And especially the closing rate at the end of every Macd Trading signals day. All the news, inside information, essential and economic information offered, is shown in that closing rate.

When there are three successive Heiken Ashi candles amongst ALL FOUR pairs that are in contract, what you desire to find is times. and in the same direction.

Fairly safe trades can be found just by discovering times when those 4 are moving together and Macd Trading Crossover in the direction of that dominating trend.

Most indications that you will find in your charting software belong to among these two classifications: You have either signs for identifying trends (e.g. Moving Averages) or indicators that define overbought or oversold circumstances and therefore offer you a trade setup for a brief term swing trade.

The technical analysis should also be identified by the Forex trader. This is to anticipate the future trend of the cost. Typical indicators utilized are the moving averages, MACD, stochastic, RSI, and pivot points. Keep in mind that the previous signs can be used in combination and not just one. This is to confirm that the rate trend holds true.

Even with this list in mind, it is essential to keep in mind that absolutely nothing is certain. There are no warranties in Forex, so run the risk of management is essential. Be a “Forex snob” and wait the trade established to fulfill whatever requirement you have actually decided to use, each time.

And in a trending market conditions Moving Average Convergence Divergence (MACD) will give you solid trading signals. The concepts are quickly relevant for routine stocks or options trades.

If you are finding unique and exciting reviews related to How To Trade MACD Crossover, and Efficient Forex Strategy, Successful Trading, Hair Removal dont forget to subscribe for email alerts service for free.