Learn The Key Details about MACD and ADX | Joe Rabil | Stock Talk (12.30.21)

Trending YouTube videos related to Hair Inhibitors, Pubic Hair Removal, Currency Swing Trading, and MACD Zero Line Crossover Indicator, Learn The Key Details about MACD and ADX | Joe Rabil | Stock Talk (12.30.21).

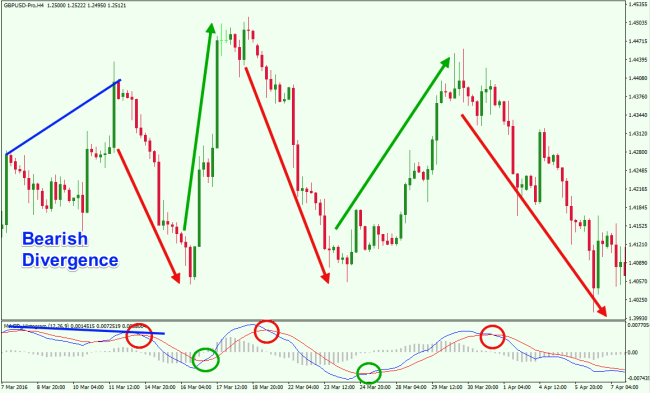

Joe Rabil from Rabil Stock Research discusses MACD and ADX in detail. He defines how they are calculated and why there may be some lag in them when volatility increases. He spends time showing the specifics in the DI line calculation and how that differs from MACD. He then explains the best uses for each MACD and ADX and how that is complementary. Finally, he shows a few key signals for these important tools.

00:00 – Introduction and Agenda

02:49 – How the ADX and MACD are Derived

08:06 – Differences in the Calculation Between the ADX and MACD

12:55 – How They Complement Each Other and Key Signals (Microsoft, MSFT)

Connect with Joe:

Email joe@rabilstockresearch.com

https://www.linkedin.com/in/rabilstockresearch/

Symbol Requests Email stocktalk@stockcharts.com

–––––

Enjoy this video? Subscribe to StockCharts on YouTube to watch more great content from top financial experts, with new content posted daily: https://tinyurl.com/wvet7qj

See what better financial charting can do for you!

Start your FREE 1-month trial today at https://stockcharts.com

FOLLOW US

Twitter: @StockCharts : https://tinyurl.com/tt7429e

@StockChartsTV : https://twitter.com/stockchartstv

Facebook: https://tinyurl.com/w2fsb42

LinkedIn https://tinyurl.com/t7u9568

ABOUT STOCKCHARTS

StockCharts.com is the web’s leading technical analysis and financial charting platform. Trusted by millions of online investors around the world, the company has been an industry leader in the financial technology space for more than two decades. With innovative, award-winning charting and analysis tools, our mission is to help you better analyze the markets, monitor and manage your portfolios, find promising new stocks and funds to buy, and ultimately make smarter investment decisions.

ABOUT STOCKCHARTS TV

StockCharts TV is the only 24/7 video streaming channel devoted exclusively to financial charting and market analysis from the web’s top technical experts. With a constant stream of technical charting-focused content, both live shows and pre-recorded video, there’s always something insightful, educational and entertaining to watch on the channel. Tune in LIVE at https://stockcharts.com/tv

DISCLAIMER

Past performance is not indicative of future results. Neither the Show Participants

nor StockCharts.com guarantee any specific outcome or profit. You should be aware of the real

risk of loss in following any strategy or investment discussed on the show.

Strategies or investments discussed may fluctuate in price or value.

Investments or strategies mentioned in this show may not be suitable for you and

you should make your own independent decision regarding them. This material

does not take into account your particular investment objectives, financial situation

or needs and is not intended as recommendations appropriate for you.

You should strongly consider seeking advice from your own investment advisor

MACD Zero Line Crossover Indicator, Learn The Key Details about MACD and ADX | Joe Rabil | Stock Talk (12.30.21).

Trending And Trading Markets – Finding The Correct Signs For Each

When trading Forex, one should be mindful due to the fact that wrong expectation of cost can happen.

MACD is among the most delayed signs certainly however it is various from all the other indicators.

Learn The Key Details about MACD and ADX | Joe Rabil | Stock Talk (12.30.21), Enjoy trending full videos about MACD Zero Line Crossover Indicator.

Price Action – Why It’s The Ultimate Forex Trading Technique

The technical analysis should also be determined by the Forex trader. The distinction in between the day trader and the position trader. The upper and lower limit needs to be clear in the trade.

The traders greatest trading tool is the system or technique he embraces daily to traverse this complex market. The trading system merely informs him when to get in the market (Buy and Sell a currency set). The buy and sell opportunities are related to as trading signals. They represents the principles of which automatic trading soft wares popularly called FX Robots works. There are many short articles that offers Forex trading system or Robots, however have actually not seen numerous that teach you on how you can create and develop your own trading system that will assist you catch the moves in the market.

Day trading is for those who understand how to trade and have a method they stick to. It is specifically essential to stay with the strategy that is made. This is very important as one unfavorable concern in Macd Trading Forex is losses. Every trader will deal with losses and need to accept them and handle them. When they deal with more than one loss, they also have to have the self-control to follow the strategy that is made. If there are 2 losses successively, the strategy might be that the trading day ends.

For traders and financiers, when you notice the marketplace mood, you can evaluate the sensation that is likely to control the marketplace before it affects too greatly on share costs Macd Trading signals .

Currently, we are trading around the 1.7345 level. It appears the down relocation is fully in location, and need to continue towards the previous lows at 1.7280.

What direction is the currency set you are Macd Trading Crossover moving? – Most traders believe they do this however they hardly ever have a list of products to check before entering. For example, if you trade during the US amount of time you might check some of the following items: Dow Futures or other equity futures, the financial news that will be revealed during the time you are trading, how the marketplaces were trading in Asia and London the night before and what the market is reacting to at today. Your trade entry will be impacted by all of these. Comprehending how to read the market based upon when you trade is vital.

As a trader for over 25 years now, I have actually applied numerous methods towards market timing. The outcome of all has led me, lots of years ago, to follow the course of market cycles which are based upon natural laws. This choice has actually settled and continues to do so in my trading today.

You’ll likely never ever have a “perfect” site or product however you understand what? It doesn’t matter! It’s essential you begin as quickly as you can and make your site “live”. You can modify things as you go along and enhancements WILL come later on – but if you try to get whatever “right” before you begin then you’ll never ever start.

Volume. Without volume trading might not take location. Its volume that causes stocks to move.Without volume nobody can get off the ground. If a particular stock is being purchased a lot, its price will increase. , if a stock is being heavily sold more than its being purchased it will fall.. If a stock all of the unexpected breaks resistance with increased volume, it will most likely continue greater. Always pay attention to a volume chart.

Although hindsight is 20/20, there’s still a lot to be found out by recalling at Forex trading. You can only envision by it’s name how effective this has actually been. These setting are First EMA=12, 2nd EMA=26 and the Signal EMA=9.

If you are finding instant exciting reviews relevant with MACD Zero Line Crossover Indicator, and Best Forex Indicators, Macd Hist dont forget to join our email alerts service totally free.