MACD Histogram Helps Determine Trend Changes #sorts video for new traders

Latest high defination online streaming top searched Short-Term Trading, Best Forex Trading, Trading Indicators, and Does Macd Divergence Work, MACD Histogram Helps Determine Trend Changes #sorts video for new traders.

**MACD Histogram** (This video is only for educational purpose)

This indicator is one of the best and it shows whether bulls or bears

are controlling prices and whether they are growing stronger or weaker.

Bulls believe that prices will rise so they buy to start with.

Bears believe that prices will fall so they sell to start with.

The slope of the MACD histogram is more important

An upward sloping of the MACD histogram shows that bulls are

becoming stronger

A downward sloping MACD histogram shows that the bears are getting

stronger.

The price trend (up or down) is likely to continue when the slop of the

MACD histogram moves in the same direction as prices.

You should always trade in the direction of the slope of the MACD histogram

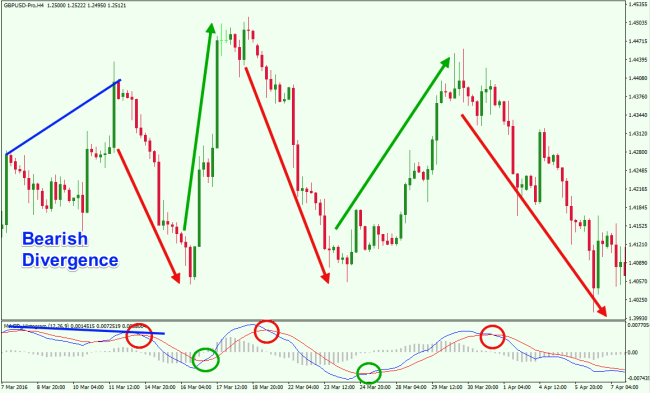

How to trade based on MACD Histogram Divergences?

Divergences between indicators and prices means they have moved in different

directions to each other.

Strongest Bearish Divergences

MACD divergence generally indicate that a major reversal is about

to occur but they do not happen at every major top or bottom

A strong bearish divergence is where prices reach a new high but

the MACD histogram makes a lower top.

This shows that the bulls are becoming weak.

To trade this you should go short when the MACD histogram ticks down after

its second top (the lower top) when prices are at a new high.

Your stop loss should be placed above the most recent high in prices

Strongest Bullish Divergence

A bullish divergence is where prices drop to a new low but the MACD

histogram makes a higher bottom.

This shows that the bears are becoming weaker.

To trade this you should buy when the MACD histogram ticks up from

its later and higher bottom, while the price is at a new low.

Your stop-loss should be placed below the latest low in prices.

#macd histogram

#macd with histogram

#how to read macd chart

#macd histogram strategy

#macd histogram buy sell signal

#macd histogram divergence

macd histogram,

macd with histogram,

how to read macd chart,

macd histogram strategy,

macd histogram buy sell signal,

macd histogram divergence

MACD Histogram Explained Simply and Understandably,

The MACD Histogram and How It Works as a Buy/Sell Signal,

MACD with Histogram Forex MT5 Indicator,

MACD Histogram And Prices Divergences – Learn Forex Trading,

**I am not SEBI registered analyst. This video is only for educational purpose.

Does Macd Divergence Work, MACD Histogram Helps Determine Trend Changes #sorts video for new traders.

Forex Newbies – 2 Very Popular Indicators And How To Utilize Them

In conclusion, doing manual set ups like MACD day trading is really hard. Marketing based on them will trigger you to lose sales. What that suggests is that you ought to see MACD in the exact same area as the trend.

MACD Histogram Helps Determine Trend Changes #sorts video for new traders, Watch popular full length videos about Does Macd Divergence Work.

Picking Forex Indicators

The technical analysis needs to likewise be determined by the Forex trader. It is a good idea to constantly paper trade a new technique before executing in a live account. You will be utilizing the default setting for the MACD.

The traders biggest trading tool is the system or method he adopts daily to traverse this complex market. The trading system merely informs him when to get in the market (Buy and Sell a currency set). The buy and offer opportunities are considered trading signals. They represents the principles of which automatic trading soft wares commonly called FX Robots works. There are lots of short articles that sells Forex trading system or Robots, however have not seen lots of that teach you on how you can produce and establish your own trading system that will assist you catch the moves in the market.

Volume – Among the very best signs of the conviction of traders. Volume, Macd Trading placed in context with cost motion, allows me to trade efficiently. To determine the significance of volume, we need a standard. What I am searching for is the % change over a typical day.

Set a target above the key level of support you see and bank your earnings Macd Trading signals just above this level, do not wait on the level to be struck because, if you hang on to long you run the risk of a return up which will consume into your earnings. Seek to bank early and take your revenue, when the odds are at there best.

In the very same manner, when the MACD Histogram stops reducing and starts increasing, go long. Location the initial stop loss at the instant minor high formed in the cost action. When rates continue to rise, change it with a routing stop.

4) Trading Arrange. When do you plan to trade? When will you accept brand-new entries or exits? Exists a point when all trades will be closed? Specific times of day are better than others depending on the Macd Trading Crossover system you are preparing. A schedule also helps you manage your life and put your priorities in proper order.

Trade “A” – Using the MACD on an everyday chart, trading 1 currency set, and whenever he notifications the lines are crossing he takes the trade. This trader will make a minimum of 25 to 50 trades by the end of the month. He will have some losers and winners, but we will offer him the benefit of the doubt and claim that he made a 250 pips for the month. I guarantee you that this trader will remain in the unfavorable after 3 months.

Hind website being 20/20, I asked myself the same question, However in my personal trading design, I used 1.7460 as my entry, which suggests I missed getting in my trades by a frustrating 4 Pips.

The above strategy is incredibly basic but all the best strategies and systems are. If you swing trade extremes, you will get a couple of excellent signals a week and this will be enough, to make you huge gains in around 30 minutes a day. There is no much better technique than currency swing trading if you want a great method to make huge earnings.

There are some reasons that some traders are reluctant to spend for companies of signals. The most risky period are the periods at which economy brand-new are arisen. Eventually you need to do what you feel comfy with.

If you are searching updated and exciting videos about Does Macd Divergence Work, and Trend Bias, Price Action Trading, Pubic Hair dont forget to subscribe for a valuable complementary news alert service totally free.