RSI and MACD Explained

Best full length videos relevant with Forex Trend Analysis, Learn Forex, Good Forex Strategy, Trading Success, and What Is MACD Crossover, RSI and MACD Explained.

“Education is the Key to a Successful Financial Future”

Subscribe today so you don’t miss an update! https://www.youtube.com/channel/UClwtLInqEcotvIiZ5ABHYIQ

⏱To schedule an appointment just click the link: https://meetme.so/LoftusWealth

Share this video with a friend:

✉️ If you have questions or would like to see a video on a certain topic email us at mgates@lwsde.com

📈 Charts courtesy of https://stockcharts.com/

Loftus Wealth Strategies

Michael P. Loftus

http://www.loftuswealthstrategies.com/

Check us out on social media!

✅ FACEBOOK – https://www.facebook.com/loftuswealth…

✅ TWITTER- https://twitter.com/mpllws

✅ LINKEDIN – https://www.linkedin.com/in/mloftus28

Not ready for retirement but want to feel confident that when you get there you’ll be able to enjoy it? We are now offering our financial planning service for only $999! This is a great offer and a small price to pay for peace of mind.

🔗 https://www.loftuswealthstrategies.com/financial-plan

FEAR & GREED http://money.cnn.com/data/fear-and-gr…

Check out our KIT page to learn what equipment we use for our videos

📷 https://kit.com/search?term=djwedge28

-~-~~-~~~-~~-~-

Please watch: “What Happens to My Digital Assets When I Die?”

-~-~~-~~~-~~-~-

What Is MACD Crossover, RSI and MACD Explained.

Trading Psychology – One Fundamental Routine To Enhance Your Trading Ability

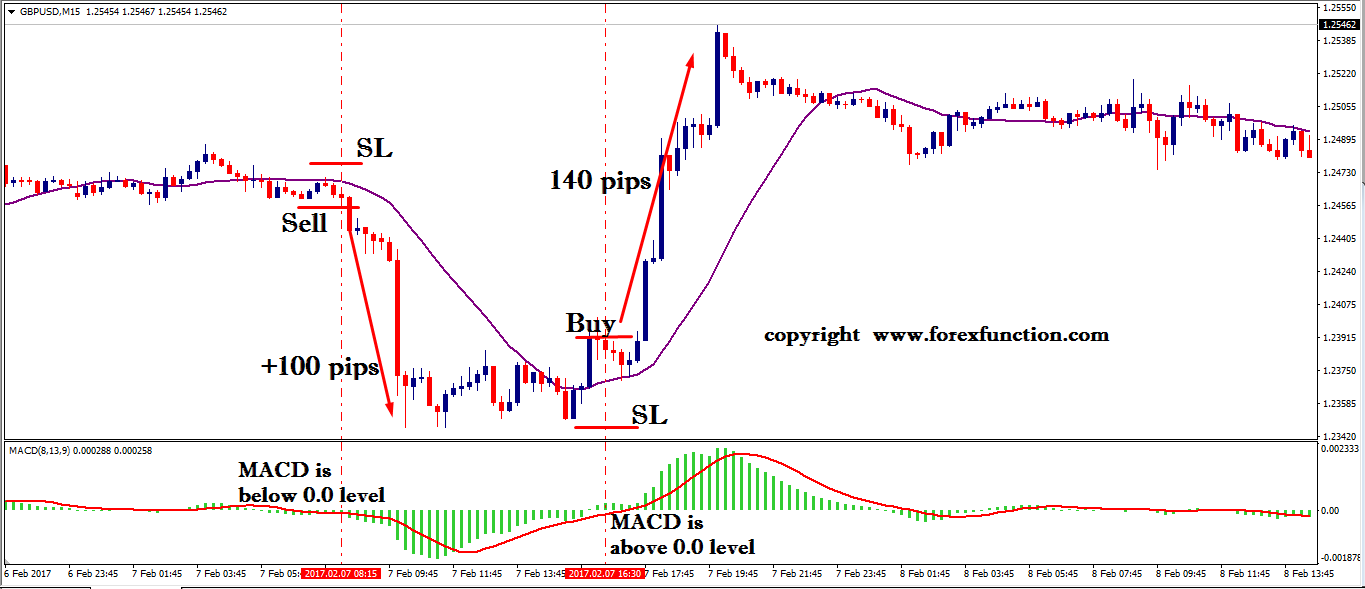

Also validate you indicate when the MACD pie chart is above the 0 line; signaling up momentum. Like MACD, when it’s sign lines hit peaks, it might be indicating a short-term rate reversal.

RSI and MACD Explained, Find interesting full videos related to What Is MACD Crossover.

When To Offer And Buy In The Forex Market, Forex Online Trading And.

Using the right mix of indications can help you paint of photo of where price is heading. A great trade is one entered and left based upon conditions and rules – no matter the result.

If you resemble me, you wish to find a method to trade the Forex that is consistent. That’s successful. That’s easy. Forex trading indicators can be your key to all of this.

Time-sensitive trades: This can be found in 2 kinds: First of all, in opening range breakouts, where a quick scalp is taken minutes before the open, in the instructions of any market thrust. I exposed a crucial trick in the previous edition of SDE on the very best Macd Trading time for the EMA 4/12/63. On the other hand, if care is not taken, the bull back preceding the breakout of the 7:45 am Nigeria time might strike your stop loss. But you can perfectly study the marketplace; and scalp to make profits prior to the main breakout. And I will encourage you constantly utilize your Bollinger Bands, preferably on a separate 15mins chart.

The distance from the top of the channel to the bottom must represent a variety adequate to be traded. Personally, I look for a variety of about forty pips from leading to bottom. , if the variety Macd Trading signals is less than forty pips I wait for the breakout trade.. A simple entry method would be to cost the leading and to purchase the bottom using really tight stops. However the smallest bit of market noise might stop out my trade prior to it has a chance to work.

, if he wants to buy the EUR/USD he will study the EUR/USD currency graph and view the development in the curve.. If the curve is falling to a lower level and then begins to rise to a higher level and the curve afterwards return to a lower level the curve advancement show that the trader ought to purchase the currency pair. The advancement in the curve could be illustrated with an inverse v indication.

Price – I personally believe price action (I use japanese candle patterns) in addition to moving typical and support and resistance. I attempt Macd Trading Crossover to choose the pattern and identify the course of least resistance is where I wish to be.

The MACD is an acronym for Moving Average Convergence/Divergence. It is a trend following momentum indication that reveals the relationship in between 2 moving averages of prices. The MACD default is the distinction between a 12-day and 26-day rapid moving average. A 9-day rapid moving average, called the signal or trigger line is plotted on top of the MACD to reveal buy/sell opportunities.

This trading tool works much better on currency pair cost history than on stocks. With stocks, cost can space up or down which causes it to offer false readings. Currency set’s cost action rarely gaps.

HIDDEN TRICKS: An extra benefit for traders technically is when there is no major news impacting the market. You will constantly see a clear trend for the day. When trading using technical signs, ensure you understand when the news is going to be released so that you can position yourself. i.e. close your trade 10 to 15 minutes prior to the (FA) news. Then 15 minutes after the (FA) news, you could trade.

And in a trending market conditions Moving Average Merging Divergence (MACD) will provide you solid trading signals. The concepts are easily appropriate for routine stocks or alternatives trades.

If you are finding unique and exciting reviews about What Is MACD Crossover, and Forex Trading Indicators – 4 Common Indicators That Will Make You Money, Currency Trading Education you should list your email address in email alerts service now.