Best TradingView Indicators That Will Change The Way You Trade

Popular videos about Market Timers, Free Forex System, and How to Avoid Macd False Signals, Best TradingView Indicators That Will Change The Way You Trade.

Today, we show you the most profitable and reliable TradingView indicators that will change the way you trade (including the insane private Buy Sell TradingView indicator). These indicators will help you spot profitable day trading, scalping & swing trading buy sell signals on forex, crypto, and stocks.

Tradingview indicators are used by many traders but are often used wrongfully. We combine all indicators discussed in the video into one profitable private strategy that can be used on any time frame for different asset classes.

If you want us to make more videos, make sure you leave a like, comment, and subscribe, thus showing your support for Quant Capital, as it requires a lot of time and resources from our team.

************IMPORTANT************

🔴ACCESS QUANT ALGO: https://quantcap.gumroad.com/l/quanteducation

🔴Our Telegram Channel: https://t.me/quant_capital_fx

🔴 Learn Our Strategies That Work: https://quantcap.gumroad.com/l/quanteducation

🔴 [TOP] Best Indicators For Scalping: https://youtu.be/bw3RJFi9jm4

✅ Business: quantcapitalsuppport@gmail.com

How to Avoid Macd False Signals, Best TradingView Indicators That Will Change The Way You Trade.

Number 1 Loser Indication – Why Trading Moving Averages Fail

The distance from the top of the channel to the bottom must represent a variety sufficient to be traded.

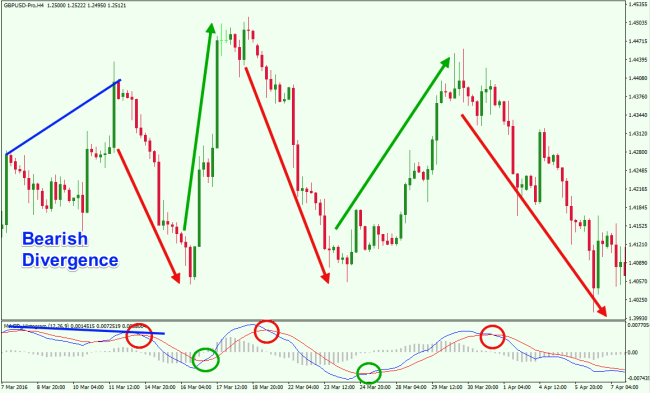

You are simply searching for MACD to be moving in the opposite direction from the pattern.

Best TradingView Indicators That Will Change The Way You Trade, Explore new reviews related to How to Avoid Macd False Signals.

Trading Suggestions – When To Purchase Or Sell

However, YOU require to decide whether you can stand 7 losers and just 3 winners in 10 trades. For some factor, trying the catch the drawback doesn’t appear to be as consistent. Nevertheless, NYSI is nearing the (gray) downtrend line.

Forex Trend Analysis all depends upon determining the start of a brand-new pattern at the correct time and the end of that pattern before it in fact happens. If you can master these 2 things, you are all set on your method to making a million dollars in the forex market. Pattern is your good friend is the oft repeated phrase.

There are lots of blended signals in the first set of charts, including a bullish Macd Trading, and bearish volume. Furthermore, the SPX 200-day MA continued to increase over the high fall and volatility, which is bullish. Additionally, the bond market rally (not shown) has sent the 10-year bond yield 45 basis points below the Fed Funds Rate, which is bearish (i.e. inverted yield curve). Some short-term technical indications (not shown) suggest SPX 1,290 will not hold and a pullback, e.g. to 1,275, will take place next week. After a pullback, SPX might rally again.

For me, my markets of option are forex & equity indices. The longer timeframe for defining major assistance and resistance, is a per hour chart, and the Macd Trading signals timeframe is anywhere from a 1 to 5 minute chart.

The Supertrend is very effective as its’ sole design was to pinpoint trends in the currency market. You can just picture by it’s name how successful this has actually been. If you are utilizing the ADX, it might be a bit harder to check out the trends, however it is simply as helpful when you know what you are doing and define ranges of success. For example, when there are crosses in the 17 to 23 levels, I know it is a go. Movement in the DI+ and the DI- will let you understand which side of the market to get on.

Look at some momentum signs to see if rate velocity has actually moved to far to quickly, to make the currency overbought. Momentum indications are simple to learn and will tell you, if the marketplace is overbought in visual form. There are lots of you can use however, the very best ones in my view are – the RSI Stochastic and Macd Trading Crossover. Which ever ones you pick, don’t utilize to lots of, a couple is enough.

Your entry is when the trendline is broken on the 15 minute chart. For this to occur, a candles body should have a close on the other side of the pattern line. Your buy single is when the next candle light opens. Look for resistance points like pivot lines that may trigger price to reverse. This is usually where you must leave the trade.

Risk/Reward. A great rule of thumb is to search for a threat: reward ratio to be at least 1:2. That implies that if you run the risk of 40 pips on a trade, a reasonable target will bank you 80 pips. A few of the very best traders in the world make winning trades just 50 to 60% of the time. They make their cash due to the fact that they win 2 or three or more times what they would have lost.

In conclusion, doing manual set ups like MACD day trading is really challenging. You need to practice this for lots of hours up until you get consistent at selecting winning trades. Or, you can use trading software application that will do this for you.

Ultimately you have to do what you feel comfortable with. You just have to be able to acknowledge which method it is going. If the system doesn’t utilize the MACD, that doesn’t mean you can’t “fine-tune” it a bit by adding it.

If you are looking unique and entertaining videos related to How to Avoid Macd False Signals, and Forex Trading Strategies, Advantages of Technical Analysis, Shaving Pubic Hair, Options Trading Course you should join in email alerts service totally free.