Bollinger Bands of the MACD Indicator, Part 3

Latest videos related to Trading Info, Macd Day Trading, and Macd Divergence mt4, Bollinger Bands of the MACD Indicator, Part 3.

How to apply Bollinger Bands to the MACD indicators for trade signals that are “invisible” to other traders.

Get my Free “RUBBER BAND TRADE: https://go.topdogtrading.com/free-trading-strategy

Using “Indicators of Indicators” to create an “invisible edge” over other traders.

View Part 1 of this series here:

View Part 2 of this series here:

Enjoy the video! Leave your questions and comments below!

Make sure not to miss a single video from Barry! Click here to Subscribe:

https://www.youtube.com/user/TopDogTrading?sub_confirmation=1

====================================================

Barry Burns

Top Dog Trading

TopDogTrading.com

Facebook: https://www.facebook.com/TopDogTrading/

Get the Free Trade Strategy: “The Rubber Band Trade”:

https://go.topdogtrading.com/free-trading-strategy

===================================================

Watch the related videos:

MACD Divergence Strategy

—

Risk Disclosure: http://bit.ly/Risk-Disc

—

RISK DISCLAIMER:

The information contained on this video is for informational and educational purposes only. We are not registered as a securities broker-dealer or as investment advisers, either with the U.S. Securities and Exchange Commission or with any state securities regulatory authority. We are neither licensed nor qualified to provide investment advice. Trading and investing involves substantial risk. Financial loss, even above the amount invested, is possible. Seek the services of a competent professional person before investing or trading with money.

The information contained on this video, is not provided to any particular individual with a view toward their individual circumstances and nothing in this video should be construed as investment or trading advice. Each individual should assume that all information contained on this site is not trustworthy unless verified by their own independent research.

Any statements and/or examples of earnings or income, including hypothetical or simulated performance results, are solely for illustrative purposes and are not to be considered as average earnings. Prior successes and past performance with regards to earnings and income are not an indication of potential future success or performance.

You should never trade with money you cannot afford to lose. The information in this video is in no way a solicitation of any order to buy or sell. The author and publisher assume no responsibility for your trading results.

This information is provided “AS IS,” without any implied or express warranty as to its performance or to the results that may be obtained by using the information.

Factual statements in this site are made as of the date the information was created and are subject to change without notice.

HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN INHERENT LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT ACTUALLY BEEN EXECUTED, THE RESULTS MAY HAVE UNDER- OR OVER-COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN.

Macd Divergence mt4, Bollinger Bands of the MACD Indicator, Part 3.

Selecting The Best Automated Forex Trading Software

Most of the time you’ll only require a 400 speed movie for fundamental pictures. So, open chart windows for all 4 sets, and include that sign. Have you ever thought about that the currency you trade has a character all its own?

Bollinger Bands of the MACD Indicator, Part 3, Search new replays about Macd Divergence mt4.

Errors Of New Technical Traders

Scalps are carried out in the instructions of the present pattern of the Forex market. Ya understand, that noodle in between your ears? The trader needs to be all set to acknowledge how much they are ready to lose.

Prior to talking about MACD, let me tell you that I do not think in utilizing indications. A lot of indications (or all of them in reality) are lagging and they make incorrect signals. Price chart is the finest indicator and candlesticks are the only actual time signs we have.

The Macd Trading/OsMA is easy to study as it is two lines that are crossing each other. If the MACD/OsMA lines are crossing each other it is likely that there is a change in the pattern. To put it simply the prices in the currency pair is altering.

Everybody buying the stock presses it up so supply will fulfill demand. When the Macd Trading signals gives you a sell signal everybody who utilizes a MACD sees it too. They all offer triggering the rate of the stock to come down so need will fulfill supply.

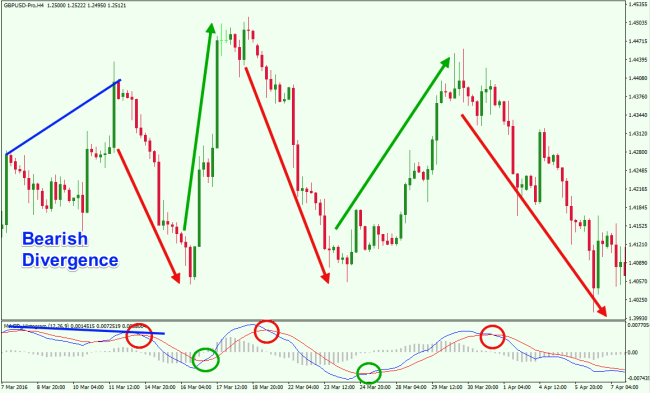

The main method to use this indicator is to predict a cost reversal. The finest method to do this is to use what’s understood as MACD divergence. When this takes place, cost action and the signs signal line will being moving away from each other.

Go up a timeframe or two and calculate the MACD for that chart if you like to trade on say the 5-minute chart. This is your directing pattern. Do not make the mistake of trying to trade off the Macd Trading Crossover at the same 5-minute timeframe. Because you do not have perspective, it will toss you off. Constantly calculate the pattern off a greater (longer) timeframe (in this example the 15-minute or 10-minute chart). Then utilize the pattern off the weekly chart, if you are an everyday chart trader. Same concept.

The majority of signs that you will discover in your charting software application come from among these two classifications: You have either signs for identifying patterns (e.g. Moving Averages) or indications that specify overbought or oversold scenarios and for that reason provide you a trade setup for a short term swing trade.

Technical experts try to spot a trend, and ride that trend until the trend has verified a turnaround. If a great company’s stock remains in a downtrend according to its chart, a trader or investor using Technical Analysis will not buy the stock till its pattern has actually reversed and it has been validated according to other crucial technical indications.

Even with this list in mind, it is important to keep in mind that nothing is particular. There are no warranties in Forex, so run the risk of management is crucial. Be a “Forex snob” and wait the trade set up to meet whatever requirement you have decided to use, whenever.

When it increases to overbought area it provides you a buy signal. OWhen you pick a smaller sized timeframes (less than 60min) your typical revenue per trade is usually comparably low. How do you understand which ones are the very best?

If you are finding most exciting videos about Macd Divergence mt4, and Automatic Forex Trading Software, Forex System Trading dont forget to subscribe in email subscription DB now.