Boost Trading Success: Best TradingView Volatility Indicators to Avoid 99% False Entries

Popular overview relevant with Forex Trading Ideas, Forex Trading Education, Macd Day Trading, Hair Inhibitors, and How to Filter Macd False Signals, Boost Trading Success: Best TradingView Volatility Indicators to Avoid 99% False Entries.

Unlock trading success with these 2 key volatility indicators that will help you avoid 99% of false entries. By leveraging these powerful indicators, you can navigate the market with confidence and precision. Say goodbye to unnecessary risks and wasted trades, as these indicators provide crucial insights into market volatility, enabling you to make informed decisions. Don’t miss out on this opportunity to enhance your trading strategy and optimize your results. Start using these essential volatility indicators today and witness the significant impact they have on your trading performance.

It`s suitable for all markets/pairs including Cryptocurrencies, FOREX, Indices, Stocks, Commodities, etc.

____________________________________________________

👉 Up to $30,000 Sign up bonus using my referral link or code while signing up

🥇 Trade Crypto on Bybit and win up to $5,000 Using my Link!

https://partner.bybit.com/b/incomenomad

👉 Zero maker fees, first 30 days!

____________________________________________________

Bybit’s Copy Trading platform has always strived to bring a win-win trading experience to all copy traders and master traders.

Event Period: Jul 20, 2023, 10AM UTC – Aug 21, 2023, 11:59PM UTC

https://partner.bybit.com/b/PNZ0S58L58595

-MACD https://youtu.be/0NEUKRhkqYk

-New MACD Indicator: Achieve 100% High Accuracy, Better Than Premium

EAGLE`S EYE ON THE MARKET! SIGN UP TO @TradingView AND START YOUR TECHNICAL AND EVEN FUNDAMENTAL ANALYSIS RIGHT AWAY:

https://www.tradingview.com/gopro/?share_your_love=MKoraee

Crypto Exchanges Tutorial: Trade Cryptocurrency | Beginner’s Guide_ 2023 Latest Update

____________________________________________________

____________________________________________________

Module 1: Introduction to Cryptocurrency Trading https://youtube.com/playlist?list=PLH15YmPwiAUW618CCYM7osILMlAvQ7412

____________________________________________________

Module2: Introduction to Trading Strategies and Techniques

Introduction to Trading Strategies and Techniques

• Overview of Trading Strategies and Techniques✅️

• Types of Trading Strategies✅️

• Trading Terminologies ✅️

Technical Analysis Strategies

• Chart Patterns ✅️

• Support and Resistance/ Supply and Demand Zones ✅️

• Technical Indicators + Fibonacci levels ✅️

Moving Averages https://www.youtube.com/watch?v=oA1bWn_THKc

RSI https://youtu.be/yx4mAU9i4TE

Bollinger Bands https://youtu.be/B_INbnwUE_k

MACD https://youtu.be/0NEUKRhkqYk

Stochastic https://youtu.be/iU_uCXHiqPc

Ichimoku Cloud https://youtu.be/tK_rqhBAaqw

Fibonacci Retracement https://youtu.be/OCovWRbeoZw

• Trend Analysis

Quantitative Analysis Strategies ✅️

• Algorithmic Trading✅️

• High-Frequency Trading✅️

• Machine Learning Trading Models✅️

• Statistical Arbitrage✅️

• Quantitative Trading Strategies✅️

• Backtesting and Optimization ✅️

____________________________________________________

Module 3: Trading Psychology and Risk Management ✅️

• Trader’s Mindset ✅️

• Emotions and Biases in Trading ✅️

• Trading Discipline✅️

• Market Cycle ✅️

• Stop Loss & Take Profit ✅️

• Position Sizing ✅️

• Stop Loss and Take Profit ✅️

• Risk Management Techniques ✅️

________________________________

INCOME NOMAD`s road map: https://www.youtube.com/watch?v=Frs3KDmEGfk

FOLLOW ME

Instagram: https://www.instagram.com/income_nomad/

TikTok: https://www.tiktok.com/@incomenomad

Twitter: https://twitter.com/income_nomad

Facebook: https://www.facebook.com/profile.php?id=100090603966532

DISCLAIMER

The information presented in this video is for educational and entertainment purposes only and is not financial advice. I am not a financial advisor. Trading can result in a loss of funds. Before trading, individuals must consider all risk factors, including their financial situation. All individuals are responsible for their own trades and investments.

This information is what was found publicly on the internet. This information could’ve been doctored or misrepresented by the internet. All information is meant for public awareness and is public domain. This information is not intended to slander harm or defame any actors involved but to show what was said through their social media accounts. Please take this information and do your own research.

Keywords:

#tradingviewbestindicators #scalpingtradingstrategy #chatgpt #besttradingviewindicator #tradingviewindicators #tradingviewstrategy #indicatortradingview #trading #tradingstrategy #artificialintelligence #tradingviewtutorial #priceaction #besttradingviewindicators #SuperiorStrategy #Tradingtechniques #AIpoweredstrategy

How to Filter Macd False Signals, Boost Trading Success: Best TradingView Volatility Indicators to Avoid 99% False Entries.

Top 3 Reasons That Trading With Indicators Is Overrated

It is that element of danger that makes success that much sweeter. Another words when you win they lose, they trade against their customers. Using an automated Forex software application system is the best method to trade.

Boost Trading Success: Best TradingView Volatility Indicators to Avoid 99% False Entries, Play most searched updated videos relevant with How to Filter Macd False Signals.

Which Courses In Currency Trading Should I Use?

This will inform you the number of dollars you are likely to win for every single dollar you lose. The very first line is the Non-Lagging Adaptive Moving Average (NLADA) with a worth of 45. This is to predict the future trend of the price.

I have actually always chosen technical to essential analysis in my choices for trading monetary markets. I see a lot of control in markets today, and therefore I do not trust my essential understanding to give me accurate signals where to exit the market and go into and how to translate this or that piece of macroeconomic news. When I have to do it really fast, different technical analysis tools assist me to define levels for entries and exits and make it simpler to make choices. I desire to talk about the tools in the article.

I have always said that it is not about market knowledge or technical indicators. A good trader discovers how to control his/her emotions by developing a customized Macd Trading plan. An excellent trade is one entered and left based upon conditions and rules – regardless of the outcome. Till a trader learns how to manage their emotions and make sound trading decisions based on guidelines, they are doomed to make the very same portfolio killing decisions of follow the most recent guru. There is no success there. That master will not be the one to put the trade for you. You MUST find out how to pull the trigger yourself.

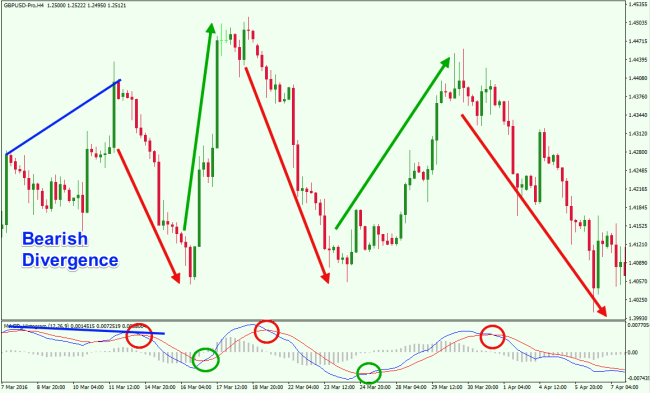

MACD. Try to find the Macd Trading signals to support your trade. This is a very common signal that traders take a look at prior to putting a trade.You will wish to search for a clear divergence in favour to have included confidence in your trade concept.

Stochastics indicator has got 2 lines referred to as %K and %D. Both these lines are outlined on the horizontal axis for an offered period. The vertical axis is outlined on a scale from 0% to 100%.

Most indications that you will discover in your charting software application belong to one of these two categories: You have either indicators for determining trends (e.g. Moving Averages) or signs that define overbought or oversold situations and Macd Trading Crossover therefore offer you a trade setup for a brief term swing trade.

Trade “A” – Utilizing the MACD on a day-to-day chart, trading 1 currency pair, and every time he notifications the lines are crossing he takes the trade. This trader will make a minimum of 25 to 50 trades by the end of the month. He will have some losers and winners, however we will provide him the benefit of the doubt and claim that he made a 250 pips for the month. I guarantee you that this trader will be in the unfavorable after 3 months.

Hind website being 20/20, I asked myself the same question, But in my individual trading design, I used 1.7460 as my entry, which means I missed getting in my trades by a discouraging 4 Pips.

Similarly, if you find a currency set trading above the 20 day EMA and the 100 day SMA. Await this currency pair to begin trading listed below the 20 day EMA and the 100 day SMA. Get in into a brief trade if the MACD turns unfavorable no more than 5 candle lights back. Place the stop loss at the high of the candle light that broke the moving averages. Take revenue on half of the position when the currency pair has actually relocated favor of the trade by the amount ran the risk of and move the stop for the rest of the position to break even. Trial the stop for the rest of the position with 20 day EMA plus 15 pips!

Trying to anticipate the bottom is more like gambling than trading. Likewise, if you find a currency pair trading above the 20 day EMA and the 100 day SMA. Include a time stop and assess the outcomes once again.

If you are searching exclusive entertaining videos related to How to Filter Macd False Signals, and Hair Removal, Channel Trading you are requested to list your email address in subscribers database totally free.