cTrader MACD Divergence Indicator

Popular high defination online streaming about Best Forex Strategy for Forex Trading, Price Action Forex, and Macd Divergence Indicator, cTrader MACD Divergence Indicator.

For more detail please check: https://www.algodeveloper.com/product/macd-divergence/ Music: www.bensound.com.

Macd Divergence Indicator, cTrader MACD Divergence Indicator.

The Day You Start To Trade Forex Without Indicators

There are a great deal of forex indications based upon trend. Likewise verify you signal when the MACD histogram is above the 0 line; signaling upward momentum. Volume – Among the very best indications of the conviction of traders.

cTrader MACD Divergence Indicator, Enjoy new full length videos about Macd Divergence Indicator.

Forex Trading: Becoming A Flexible Trader

This is to verify that the price pattern is real. How can we as pattern traders remain one action ahead of the financial markets? Are you considering starting to trade the Foreign Exchange market?

The very first set of charts include an SPX six-month daily chart that reveals a W-pattern and a rather bullish inverse head & shoulders with the neck line at 1,290. SPX has usually held 1,290, along with the 10-day MA, over the past seven trading days, in the belief a brand-new high (above 1,326) will be reached.

I define all significant support and resistance based upon a greater timeframe, and after that seek to make money from movement in between these areas on a smaller Macd Trading timeframe.

For financiers and traders, when you pay attention to the market state of mind, you can assess the sensation that is likely to dominate the market before it impacts too greatly on share costs Macd Trading signals .

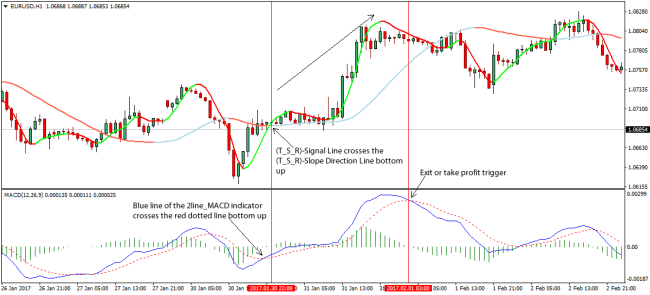

The primary way to use this sign is to predict a cost reversal. The best method to do this is to utilize what’s called MACD divergence. Price action and the indicators signal line will being moving away from each other when this takes place.

Most signs that you will find in your charting software application belong to one of these 2 categories: You have either indicators for identifying patterns (e.g. Moving Averages) or signs that define overbought or oversold situations and Macd Trading Crossover for that reason provide you a trade setup for a short term swing trade.

So you have a MACD sign on your chart. When it increases to overbought territory it provides you a buy signal. However it also provides numerous countless other traders a buy signal. You all purchase the stock anticipating it to go up.

The technical analysis should likewise be determined by the Forex trader. This is to forecast the future trend of the rate. Common signs used are the moving averages, MACD, stochastic, RSI, and pivot points. Note that the previous signs can be used in mix and not only one. This is to confirm that the cost pattern holds true.

Always validate the trading signals given by the pie chart with the price action. It implies the price action will continue to move in the exact same instructions if the prices and the pie chart make brand-new highs or brand-new lows together.

What that implies is that you need to see MACD in the exact same area as the trend. This is necessary as one negative problem in trading Forex is losses. Then 15 minutes after the (FA) news, you might trade.

If you are looking most exciting comparisons about Macd Divergence Indicator, and Forex News, Trend Analysis dont forget to signup for newsletter for free.