Hopper Strategies: How to use the MACD – Summary

Best replays relevant with Options Trading Education, Trading Stocks, Trading Game, Free Forex System, and When the MACD Crosses the Zero Line, Hopper Strategies: How to use the MACD – Summary.

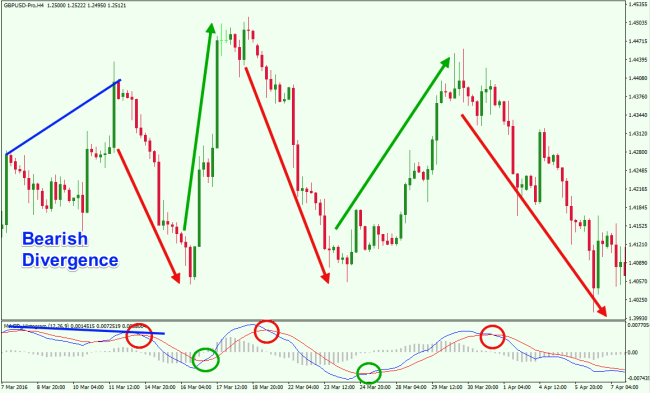

MACD Lesson #1 is about The Hopper. It’s a strategy for identifying change in the current market condition. Sometimes it’s a point of entry for your trade, but it can also be used to find exits, targets, stop losses, and more. The MACD is loaded with information about direction, momentum, and even when the market requires the passage of time before it moves again. This is just the beginning.

Watch the whole first lesson here: https://www.youtube.com/watch?v=xsqAxvcnAKg

When the MACD Crosses the Zero Line, Hopper Strategies: How to use the MACD – Summary.

Fibonacci Forex Trading – How Anyone Can Trade Forex Successfully

This implies a pattern shift will occur in the future. They have legitimate reasons to think this, but they do not meet our standards of going into trades. These signs will fail you on numerous levels!

Hopper Strategies: How to use the MACD – Summary, Search new complete videos relevant with When the MACD Crosses the Zero Line.

Learning How To Trade The Forex Market – Why Many People Do It Wrong

You all buy the stock expecting it to go up. Rest of the time, the marketplace is range bound or what you call combining. Front month is OKAY however you must leave the very same day or your danger is much greater.

When you find out about forex trading there are lots of technical tools to master, but one of the simplest to utilize is the pivot point. Pivot points deal with support and resistance levels to offer you an indicator of entry and exit points for your forex trades.

I’m not composing this short article to dissatisfy you but to clarify this problem to you and lead you to a good way of believing in order to assist you finding your lucrative trading system. If you actually wish to trade and follow a successful system, definitely you need to not depend on those indicators. Somebody told me once; your system needs to be based upon a combination of indications like Macd Trading. I said AHA! That sounds cool! I began my research study and wound up by the same result. The majority of the time those indications create false signals. The funny thing is that all the e-books I have seen had only elaborated the excellent signals and conceal all most of the incorrect signals.

However there is one indication, one core piece of info, that is constantly approximately date and always correct. That piece of information, is cost. And particularly the closing price at the end of every Macd Trading signals day. All the news, details, economic and fundamental information offered, is reflected in that closing rate.

Utilizing RSI we will have tools that will assist us comprehend the currencies personality such as RSI Range, RSI Range Shifts, Momentum 1 and 2 and the 4 RSI Trading Signals. All of these methods can be used to learn more about a specific currency pair like it was your best pal.

Create a Cost Structure List: Now that you have your measuring points, start to look at just those areas of price motion where the indicator was at your determining points. Clues need to start emerging about the rates responses to these levels. If there isn’t an overriding theme, you might to refine your Macd Trading Crossover measuring points. Make a list of the important things you are seeing at these levels. Id price continuing to relocate an upward direction, does it reverse, does it go sideways.

A lot of traders lose since they get in too early. Since they think that they have found a great reversal signal, they desire to hit the top and bottom of the patterns and so they go versus the forming and continuous pattern. the pattern has been choosing such a long time and it is time to reverse and. feelings like this.

The world has emergency situations simply waiting to boil over all the time. How can we as pattern traders stay one step ahead of the monetary markets? Markets which are absorbing and reacting to all these occasions continuously, and more notably, quickly?

The fastest way to evaluate your system is to go to the marketplace chart that accompanied the trading plat form your broker provided you to access the brokerage. Trade your new system live on a demo represent at least one month. This will offer you a feel for how you can trade your system when the marketplace is moving.

Which ever ones you select, don’t utilize to lots of, a couple suffices. You require to practice this for lots of hours up until you get constant at choosing winning trades. That master will not be the one to position the trade for you.

If you are searching best ever exciting comparisons relevant with When the MACD Crosses the Zero Line, and Free Trading System, Successful Forex Trading dont forget to subscribe our email subscription DB now.