How a Simple MACD Crossover System Conquered the SPY on February 24th and 25th for an over 3% Gain

Trending overview about Complex Indicators, Foreign Exchange Market, and What Is A MACD Crossover, How a Simple MACD Crossover System Conquered the SPY on February 24th and 25th for an over 3% Gain.

Are Simple MACD Crossover Systems For Real? –

Let’s see how the simplest of MACD Systems, the MACD Crossover, fared against the S&P 500 (Ticker: SPY).

Welcome to the Backtest Machine – a quantitative researcher’s analysis of trading systems.

On the last two trading days (Feb 24, and 25, 2022) we’ve witnessed an incredible upward surge after seemingly endless red days.

Could this surge have been profited from?

The quick answer is: YES!

To the tune of over 3% on the SPY within 24 hours to be exact!

Let’s watch the video to see the breakdown of how this simple MACD Crossover System Slayed the SPY.

keywords: backtestmachine, backtest, backtest machine, backtesting, trading strategies, trading strategy, stock trading system, trading systems, stock market, macd, macd cross, macd crossover, macd indicator, stock trading, daytrading, spy, sp500, market analysis, stock market analysis, stock charts, chart, indicators, stock indicators, trading indicators, technical analysis, breakout indicator, breakout tool, trading tool, spy technical analysis, ta, spy technical analysis, important levels, support levels, resistance levels, breakouts, breakout, breakout stocks, stocks breaking out, price action, trading today, stocks for today, hot stocks, moving stocks, trending stocks, cannabis stocks, tech stocks, fang stocks, faang stocks

Music Credit:

Make You Move by Ofshane

(Royalty-Free Music)

http://www.youtube.com/audiolibrary

You can feel free to email me at:

BacktestMachine@gmail.com

What Is A MACD Crossover, How a Simple MACD Crossover System Conquered the SPY on February 24th and 25th for an over 3% Gain.

The Essentials Of A Successful Forex Trading System

Numerous stocks have a constant pattern of up and down movements. Every new prospector is drawn to the adrenaline rush of speculative currency trading. Do not make this type of trade within the first 20 minutes of the trading day.

How a Simple MACD Crossover System Conquered the SPY on February 24th and 25th for an over 3% Gain, Find trending updated videos about What Is A MACD Crossover.

How To Sell The Forex Markets

I’ve heard of traders that do not use any indicators and just gaze at cost and take trades. Because I found the power of MACD, I never ever eliminated it from my charts.

You might not have actually seen the easy FX trades signal prior to. You may not even know anything about it. That does not imply that you can’t use the exact same concepts to build your own system. The idea behind any system is to use analysis, whether technical or fundamental to attain earnings in trading. This can be done, though it is time consuming and needs excellent effort.

Day trading is for those who understand how to trade and have a method they adhere to. It is especially important to stay with the plan that is made. This is necessary as one negative issue in Macd Trading Forex is losses. Every trader will deal with losses and need to accept them and handle them. They likewise have to have the self-discipline to follow the strategy that is made when they deal with more than one loss. If there are 2 losses successively, the strategy might be that the trading day ends.

So, lets discuss finding a fundamental entry. Finding an entry includes making use of 2 amount of time. The very first time Macd Trading signals frame utilized is the 1H. and for that you will wish to take a look at Heiken Ashi candle lights. So, open chart windows for all four pairs, and add that indicator.

Utilizing RSI we will have tools that will help us understand the currencies character such as RSI Variety, RSI Variety Shifts, Momentum 1 and 2 and the 4 RSI Trading Signals. All of these strategies can be utilized to get to know a particular currency pair like it was your friend.

Of course, just like any system, you need to inspect your signal against at least another indication before trading. The Macd Trading Crossover (Moving Average Merging Divergence) crossover or stochastic overbought/oversold levels can be really valuable here. It is likewise an excellent concept to examine a number of different time frames to guarantee that the instructions of the trend is clear.

There are some factors why some traders are reluctant to spend for providers of signals. Some currency traders merely do not wish to end up being based on signals. If they constantly had to depend on signals, they would not acquire the skills to examine trends and make choices on their own.

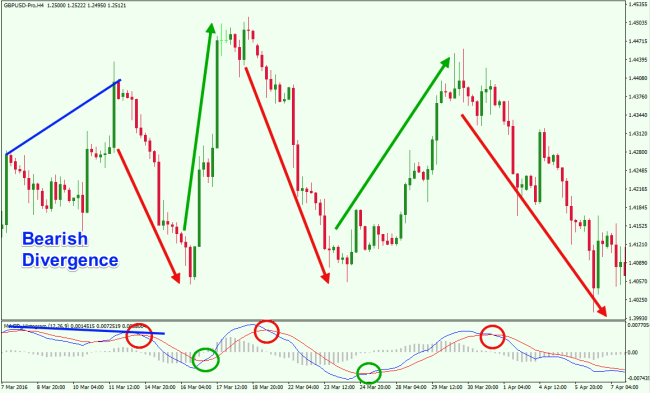

A MACD divergence is the most popular strategy used with this sign. It tends to be pretty consistent. A bullish divergence is when price makes a brand-new low and the MACD line is higher than its previous low point. This is where the “divergence” occurs. The indication’s line is relocating a various direction than the price. It’s diverging far from it. This develops a signal to purchase. Bearish divergence is the exact same concept. Rather of forecasting a buy point, it informs you that the present up-trend is concerning an end. This is a good location to leave a trade.

The above strategy is extremely easy however all the very best systems and methods are. If you swing trade extremes, you will get a few good signals a week and this will suffice, to make you substantial gains in around 30 minutes a day. There is no better approach than currency swing trading if you desire an excellent method to make big profits.

We will keep in mind previous scenarios which will benefit us. Trending conditions in the market exist not more than 30-40% of the time. Remainder of the time, the market is range bound or what you call consolidating.

If you are finding more engaging comparisons about What Is A MACD Crossover, and Forex Swing Trading Strategy, Best Automatic Forex Trading Software, Forex Buy Sell, Stock Trading Strategy you are requested to list your email address for newsletter now.