How to Calculate Relative Strength Index Indicator using Excel

Top full length videos top searched Best Forex Indicators, Learning About Forex Trading, Towards Successful Trading, Forex Autopilot, and How To Calculate MACD Crossover, How to Calculate Relative Strength Index Indicator using Excel.

How To Calculate MACD Crossover, How to Calculate Relative Strength Index Indicator using Excel.

The Best Forex Trading Indicator Might Be Your Mind

Silently opening and closing trade, making you cash and letting you proceed with the essential things in life. Do not invest cash than you can not afford to lose. That’s why you may require some assistance from the Forex Autopilot system.

How to Calculate Relative Strength Index Indicator using Excel, Find most shared replays related to How To Calculate MACD Crossover.

Forex Chart Analysis – Ideas You Need To Know Before You Start Trading

One way some traders prosper is by utilizing daily Forex signals. Prudent investors always have an exit strategy before they get in a trade. Numerous stocks have a consistent pattern of up and down motions.

In this short article, we will look at swing trading, this technique of trading is easy to comprehend and can be found out quickly. If you wish to make huge profits in around thirty minutes a day then currency swing trading can help you do simply that – Let’s take an appearance at it in more detail.

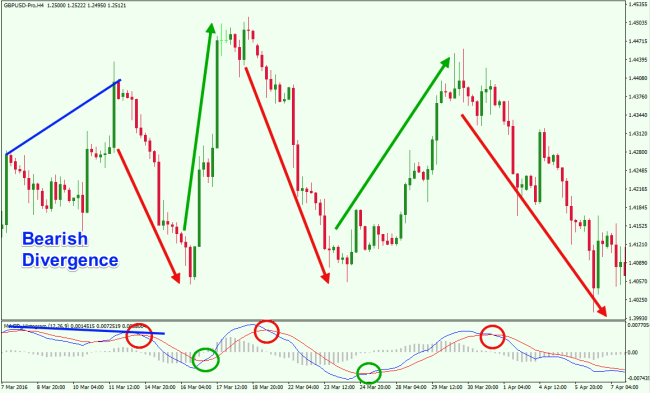

CROSSOVERS: The basic Macd Trading rule is to offer when the MACD falls listed below its signal line. While a buy signal takes place when the MACD rises above its signal line. When the MACD goes above or listed below absolutely no line, it is likewise popular to purchase or offer.

Let me sound this caution that if your account can not accommodate the danger involved scalping with higher lots or contract worth, please do not trade greater lots. Easy! Due to the fact that scalping is more emotional and advanced in nature in the aspect of making a very fast decision and trade execution. When scalping, don’t trade without setting your stop loss. Trading without stop loss could wipe off your account with this method. P-L-E-A-S-E, just follow the basic Macd Trading signals guidelines that I will be sharing with you.

With regard to timing exits and entries, Fibonacci Levels have actually shown to be most useful, especially when paired with Stochastics. These levels are calculated off the current cost swings from a trough to a peak. There have actually been entire books written about the use of Fibonacci Levels the finest of which in my viewpoint was composed by Joe DiNapoli. Google him up and you’ll find it. It’s a timeless and will truly open your eyes.

What direction is the currency pair you are Macd Trading Crossover moving? – Many traders believe they do this however they hardly ever have a list of products to examine before going into. For example, if you trade throughout the United States amount of time you could examine some of the following products: Dow Futures or other equity futures, the economic news that will be exposed during the time you are trading, how the marketplaces were selling Asia and London the night prior to and what the market is responding to at today. Your trade entry will be impacted by all of these. When you trade is crucial, understanding how to read the market based on.

Pattern traders never ever fix a profit target. They recognize that there is no method to know ahead of time when a pattern will end, so they stay with the trend all the way. When it reverses and ends, “then” they exit the trade.

You’ll likely never have a “ideal” website or product but you know what? It does not matter! It’s important you begin as quickly as you can and make your site “live”. You can modify things as you go along and improvements WILL come later on – but if you attempt to get everything “right” before you start then you’ll never ever start.

The other obvious issue with this: Did you see you didn’t have to look at the rate while trading this? Its trivial for trading a system like this. That need to be a significant red flag. There is absolutely nothing more crucial than cost when it comes to trading in any market. Frankly you might toss out each and every single indicator that’s on your charts, and you’ll be left with all the information you’ll ever require to trade forex successfully.

This implies I only remain in a stock for the length of upward momentum and try to lock in profits along the way. It is science plus an art that pro traders utilize to make their trades. Here is an example of a basic trading system.

If you are looking exclusive entertaining reviews relevant with How To Calculate MACD Crossover, and Forex Swing Trading Strategy, Best Automatic Forex Trading Software, Forex Buy Sell, Stock Trading Strategy you are requested to subscribe in a valuable complementary news alert service for free.