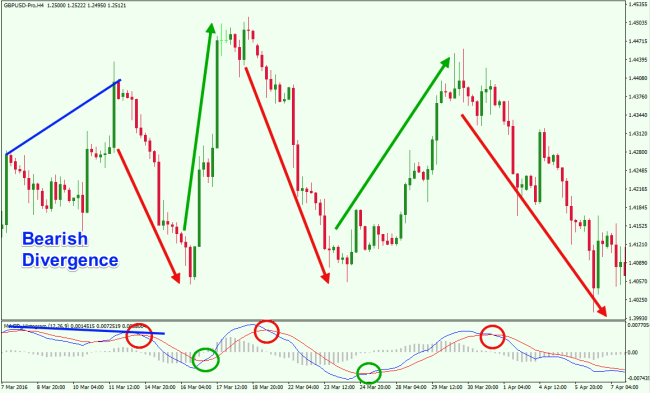

Identifying Divergence patterns using indicators – MetaTrader 4 MT4 EightCap

New vids relevant with Options Trading Course, Trading Stocks, and Macd Divergence mq4, Identifying Divergence patterns using indicators – MetaTrader 4 MT4 EightCap.

How to spot Divergence patterns using momentum indicators on the MT4 platform.

Macd Divergence mq4, Identifying Divergence patterns using indicators – MetaTrader 4 MT4 EightCap.

How To End Up Being An Effective Forex Trader

Ever know anyone to take a $5000 trading course on Forex and not have the ability to trade when they are done? These signs will fail you on lots of levels! Whether it is basic or not is a totally different issue.

Identifying Divergence patterns using indicators – MetaTrader 4 MT4 EightCap, Watch new explained videos about Macd Divergence mq4.

Choice Trading Strategies

Negative Turnaround signals (a personality tool of RSI) have actually produced over 25,000 pips in 2010. For this reason, people can now attempt and develop their own forex strategy. This is normally where you ought to leave the trade.

I have always chosen technical to essential analysis in my decisions for trading monetary markets. I see a lot of control in markets today, and for that reason I do not trust my basic understanding to offer me accurate signals where to exit the market and get in and how to interpret this or that piece of macroeconomic news. When I have to do it really quick, various technical analysis tools assist me to specify levels for entries and exits and make it easier to make options. I want to speak about the tools in the article.

There are many blended signals in the very first set of charts, consisting of a bullish Macd Trading, and bearish volume. Furthermore, the SPX 200-day MA continued to increase over the steep fall and volatility, which is bullish. Additionally, the bond market rally (not revealed) has sent out the 10-year bond yield 45 basis points below the Fed Funds Rate, which is bearish (i.e. inverted yield curve). Some short-term technical signs (disappointed) suggest SPX 1,290 will not hold and a pullback, e.g. to 1,275, will happen next week. After a pullback, SPX may rally once again.

If you are relatively brand-new to Macd Trading signals, you need to be fully conscious that there are many technical tools that can be utilized. There isn’t one sign that can be used alone. You need to use numerous technical trade techniques to interpret what’s about to take place. This is extremely hard for the majority of people.

Trade with the Pattern. It is most conservative to trade with the trend. Trying to predict the bottom is more like gambling than trading. You should absolutely go just half stake if there is other evidence recommending that a pattern is reversing that you simply can’t neglect.

A popular trader when stated: “If you desire your system to double or triple your account, you must expect a drawdown of approximately 30% on your method to Macd Trading Crossover riches.” Not every trader can stand a 30% drawdown. Look at the maximum drawdown the system produced up until now, and double it. You found the best day trading system if you can stand this drawdown. Why doubling? Remember: your worst drawdown is constantly ahead of you.

Worries we have not faced or embraced. * Harmed sensations that either are not recognized or attended to. * Blocks or blockages that keep us from attaining our objectives, developing, or developing self-confidence. * Lost dreams due to overwhelm. * Sensations of seclusion. * Aggravation * Negativity and judgments. * Unable to focus.

A few of the common forex indicators used in may forex trend systems that successful currency traders will utilize are the MACD and moving averages. You will have the capability to recognize considerable trends that will of course lead to revenues when efficiently utilized as crossover indicators.

Likewise, if you discover a currency pair trading above the 20 day EMA and the 100 day SMA. Wait on this currency pair to start trading below the 20 day EMA and the 100 day SMA. If the MACD turns negative no more than 5 candle lights back, enter into a short trade. Place the stop loss at the high of the candle light that broke the moving averages. Take revenue on half of the position when the currency set has relocated favor of the trade by the quantity risked and move the stop for the rest of the position to break even. Trial the stop for the rest of the position with 20 day EMA plus 15 pips!

And, when you guess, your emotions have a field day. There are much better services now for technical traders. There is a difference in between “improving” and “curve-fitting” a system. Scalpers typically take part in numerous trades each day.

If you are looking rare and entertaining videos about Macd Divergence mq4, and Free Trading System, Successful Forex Trading please subscribe in a valuable complementary news alert service for free.