Learn to trade bearish MACD divergence on PVH stock #trading #macd #divergence

Interesting YouTube videos about Forex Checklist, Trading Forex Online, Managed Forex Account, Free Trading System, and What Is Macd Divergence in Trading, Learn to trade bearish MACD divergence on PVH stock #trading #macd #divergence.

MACD Divergence FREE Telegram Channel

The channel automatically publishes MACD divergences for companies in the top 500 S&P and top 100 Nasdaq on a regular basis. There are FREE and VIP versions of the channel, now they are both free.

https://t.me/MACD_Divergences

Telegram Bot allows you to quickly check the stock fundamental data, as well as see the main technical indicators, including the momentum system, ATR and even short interest.

https://t.me/TradeWizardBot

Trade Wizard Blog

Useful information about the MACD indicator and divergence.

https://tradewizard.pro/

Robovoice: https://freetts.com

Music: http://bensound.com

What Is Macd Divergence in Trading, Learn to trade bearish MACD divergence on PVH stock #trading #macd #divergence.

Typical Directional Index (Adx) – Can It Be Used To Trade Forex Beneficially?

Immediately restores every 90 days from membership date. A great guideline is to search for a risk: benefit ratio to be a minimum of 1:2. This is generally where you must exit the trade.

Learn to trade bearish MACD divergence on PVH stock #trading #macd #divergence, Enjoy latest high definition online streaming videos about What Is Macd Divergence in Trading.

How To End Up Being An Effective Forex Trader

An excellent guideline is to search for a risk: benefit ratio to be at least 1:2. There is no noticeable consistent move in either direction. There are a lot of forex indications based upon trend.

Although hindsight is 20/20, there’s still a lot to be discovered by recalling at Forex trading. This post was composed at around midnight, March 24, 2006. By the time you read this the trading activity which we’re talking about will have already happened.

Day trading is for those who know how to trade and have a method they stick to. It is specifically essential to stick to the plan that is made. This is necessary as one unfavorable problem in Macd Trading Forex is losses. Every trader will face losses and need to accept them and handle them. They likewise need to have the self-discipline to follow the method that is made when they face more than one loss. The strategy could be that the trading day ends if there are 2 losses successively.

MACD. Try to find the Macd Trading signals to support your trade. This is a really common signal that traders look at prior to placing a trade.You will wish to try to find a clear divergence in favour to have actually included confidence in your trade idea.

Currently, we are trading around the 1.7345 level. It appears the down move is fully in location, and ought to continue towards the previous lows at 1.7280.

Here is an example of a standard Macd Trading Crossover system. This system has actually not been evaluated for performance therefore is ONLY for instance functions. Do not trade using these guidelines.

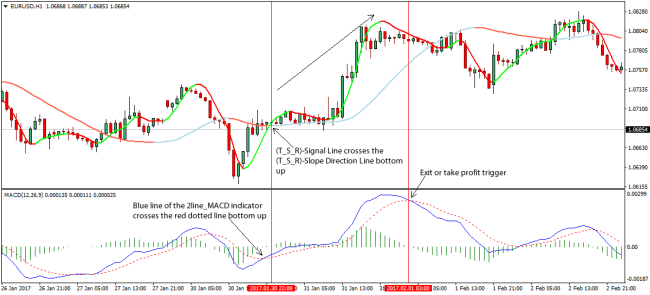

The MACD is an acronym for Moving Average Convergence/Divergence. It is a trend following momentum indicator that shows the relationship in between two moving averages of prices. The MACD default is the distinction between a 12-day and 26-day rapid moving average. A 9-day exponential moving average, called the signal or trigger line is outlined on top of the MACD to reveal buy/sell opportunities.

MACD is among the most postponed signs certainly but it is different from all the other indicators. Since I found the power of MACD, I never removed it from my charts. MACD is a great sign and if you seek advice from it in your trades, you earn less mistakes.

There is little time or space to discuss in information all the offered methods there are in identifying market cycles. I’ve invested decades on this subject and have actually streamlined much of my analysis by method of software, considering that routine analysis can be rather time taking in without the aid of computers. However if this article assists you to see that trading without using cycle timing may be impeding your trading development, I have actually done my job.

Utilizing a signal supplier a couple of years back I discovered this staggered method. Do you go into a trade and just have it reverse and take you out at a loss? Take an appearance at the Profit Element (Gross Profit/ Gross Loss).

If you are searching updated and exciting comparisons related to What Is Macd Divergence in Trading, and Forex Checklist, Efficient Forex Strategy, Trading 4x Online, Free Forex System please join for newsletter now.