Learn to trade bullish MACD divergence on IBM stock #macd #divergence #trading

Top vids about Online Forex Charting, Forex System Trading, Successful Forex Trading, Automated Forex Trading System, and How to Use Macd Divergence, Learn to trade bullish MACD divergence on IBM stock #macd #divergence #trading.

MACD Divergence FREE Telegram Channel

The channel automatically publishes MACD divergences for companies in the top 500 S&P and top 100 Nasdaq on a regular basis. There are FREE and VIP versions of the channel, now they are both free.

https://t.me/MACD_Divergences

Telegram Bot allows you to quickly check the stock fundamental data, as well as see the main technical indicators, including the momentum system, ATR and even short interest.

https://t.me/TradeWizardBot

Trade Wizard Blog

Useful information about the MACD indicator and divergence.

Robovoice: https://freetts.com

Music: http://bensound.com

How to Use Macd Divergence, Learn to trade bullish MACD divergence on IBM stock #macd #divergence #trading.

Trading Psychology – Reverse The Frustrations In Your Trading

Be clever, beware, and follow our safety standards, your impulses, and the spirit in all your dating activity. Utilize the MACD as a big image sign – when it crosses, start looking for matching crosses in the stochastics.

Learn to trade bullish MACD divergence on IBM stock #macd #divergence #trading, Play most searched updated videos about How to Use Macd Divergence.

Fibonacci Forex Trading – How Anyone Can Trade Forex Successfully

One method some traders succeed is by using day-to-day Forex signals. It made no difference what the experts stated, or what the prevailing belief was. Choose which method you would like to exit and stick to it.

If you resemble me, you desire to discover a method to trade the Forex that corresponds. That’s profitable. That’s easy. Forex trading signs can be your secret to all of this.

A few of the stock signals traders look at are: volume, moving averages, Macd Trading, and the stochastic. They likewise need to search for floors and ceilings in a stock chart. This can reveal a trader about where to get in and about where to get out. I say “about” because it is quite tough to guess an “specific” bottom or an “precise” top. That is why locking in profits is so so vital. , if you don’t lock in revenues you are actually running the danger of making a worthless trade.. Some traders end up being truly greedy and it only hurts them.

When confronted with several choices, most customers have trouble making a clear choice. They often respond by hesitating – and never ever making a choice. Macd Trading signals When this happens, you lose a sale you currently had.

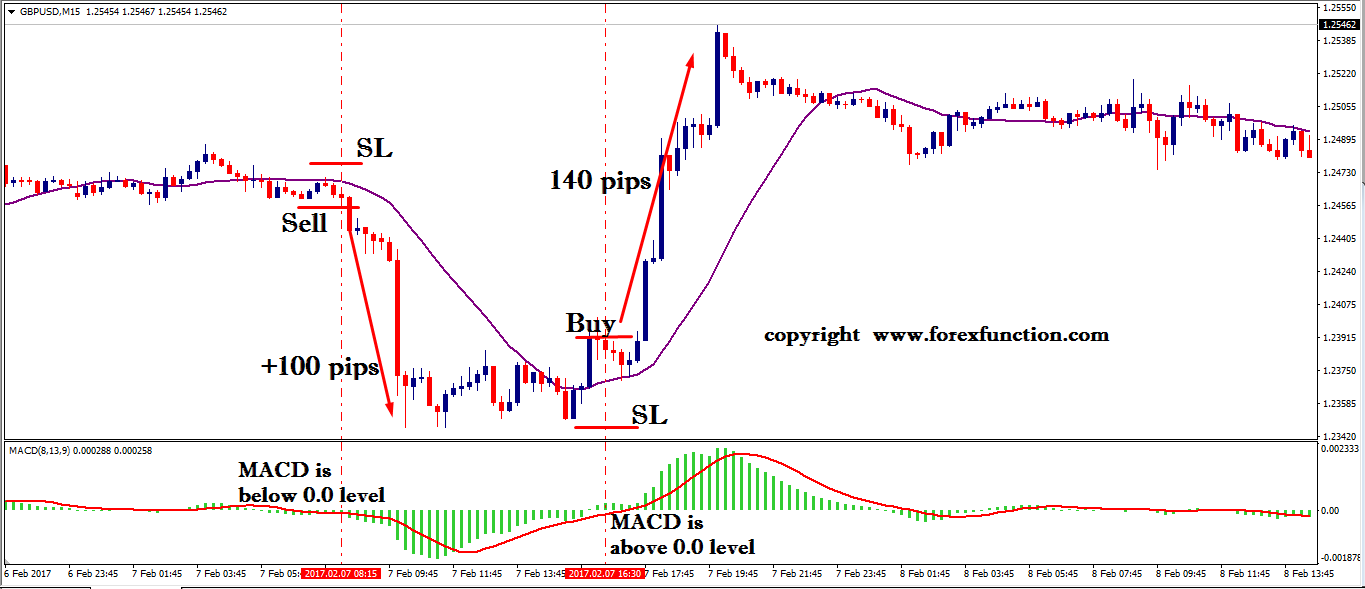

In the exact same way, when the MACD Pie chart stops reducing and begins increasing, go long. Place the preliminary stop loss at the instant small high formed in the rate action. When prices continue to rise, change it with a trailing stop.

Scalpers typically engage in numerous trades daily Macd Trading Crossover . Some traders execute several trades and make revenues with ease. Don’t stress, I will teach you the technical know-how of scalping the marketplace. Scalps are carried out in the direction of the current pattern of the Forex market. You can’t flee from the reality that the “trend is your friend” if you don’t understand the trend of the market, do not put any order.

This has actually absolutely been the case for my own trading. My trading successes leapt leaps and bounds when I came to realize the power of trading based on cycles. In any given month I average a high portion of winning trades against losing trades, with the few losing trades leading to unbelievably little capital loss. Timing trades with identify precision is empowering, only leaving ones internal psychological and psychological baggage to be the only thing that can undermine success. The approach itself is pure.

Technical experts try to spot a pattern, and ride that trend up until the trend has actually confirmed a turnaround. If a great company’s stock is in a downtrend according to its chart, a trader or financier using Technical Analysis will not purchase the stock until its trend has reversed and it has been validated according to other crucial technical indicators.

In our trading group, a few of our traders have been utilizing this strategy really effectively. This is a longer term trade, typically lasting a week or more, and takes patience to develop, perseverance while in the trade, and understanding when to exit the trade. The charts exist to assist you. Delighted trading.

It seems all over you go, people are just selling these forex trading systems in a box. Finding an entry includes using two time frames. By far the most-used level is a 0.618 retracement.

If you are finding unique and entertaining comparisons related to How to Use Macd Divergence, and Stock Trading, Trading Forex, Trading Strategy dont forget to list your email address our newsletter for free.