Most Effective MACD Strategy for Stocks, Day Trading & Forex (Must Know)

Best videos relevant with Market Timers, Free Forex System, and MACD Crossover Above Zero Line, Most Effective MACD Strategy for Stocks, Day Trading & Forex (Must Know).

In this video, I’m disclosing a simple, high win rate MACD Indicator Strategy.

The MACD also known as The Moving Average Convergence Divergence, is a simple and highly effective Indicator used by the Traders. It is a Trend Following Momentum Indicator that is calculated by the Difference between 26 Exponential Moving Average and 12 Exponential Moving Average.

Ignore Tags:

day trading,day trading strategies,stock trading,swing trading strategies, macd indicator, best macd indicator,effective macd trading strategies,macd indicator explained,how to trade macd indicator, best forex macd strategy, macd crypto strategy,macd day trading strategy,macd swing trading strategy,macd crossover strategy,macd indicator cryptocurrency

MACD Crossover Above Zero Line, Most Effective MACD Strategy for Stocks, Day Trading & Forex (Must Know).

Harmonic Trading Patterns Versus Indicators

When was the last time you really hung around with your pair? Lastly you require to be able to back test the lines. Want to bank early and take your earnings, when the chances are at there finest.

Most Effective MACD Strategy for Stocks, Day Trading & Forex (Must Know), Play new replays relevant with MACD Crossover Above Zero Line.

Trading Psychology – 7 Actions To Ending Up Being An Excellent Trader

I attempt to choose the pattern and identify the path of least resistance is where I want to be. However how excellent are they in assisting you make stock trading decisions? This post was written at around midnight, March 24, 2006.

Are you considering starting to trade the Forex market? Forex trading can be approached in various ways. One way some traders prosper is by utilizing everyday Forex signals.

As I’ve played with these 2 I have actually added and deducted other indications to complement them: EMA Crossover Notifies, Macd Trading, Awesome Oscillator, RSI, Stochastics, CCI – the gamut. When all the dust is settled I discover they work best by themselves without all the additional noise produced by extra signs.

The distance from the top of the channel to the bottom must represent a variety adequate to be traded. Personally, I try to find a variety of about forty pips from top to bottom. If the range Macd Trading signals is less than forty pips I await the breakout trade. An easy entry method would be to sell at the leading and to purchase the bottom utilizing very tight stops. However the slightest bit of market noise could stop out my trade before it has a chance to work.

MACD means “moving typical convergence/divergence”. Now that’s a mouth full. It is a graphical representation of the typical rate pattern of a currency set. Individuals add this to the bottom of their charts to assist anticipate the pattern (direction either up or down) of a currency set.

A well-known trader as soon as stated: “If you desire your system to double or triple your account, you must anticipate a drawdown of as much as 30% on your method to Macd Trading Crossover riches.” Not every trader can stand a 30% drawdown. Look at the maximum drawdown the system produced up until now, and double it. You discovered the right day trading system if you can stand this drawdown. Why doubling? Keep in mind: your worst drawdown is constantly ahead of you.

The finest buy signals happen when the MACD Pie chart is listed below the center line and the slope turns upward. In the very same manner, the best sell signals are offered when the MACD Histogram is above the center line and the slope turns downward showing that the bulls have lost control.

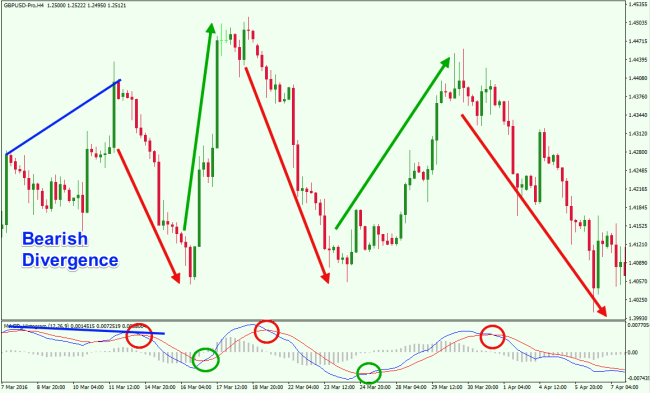

A MACD divergence is the most popular method utilized with this indicator. It tends to be pretty consistent. A bullish divergence is when rate makes a new low and the MACD line is higher than its previous low point. This is where the “divergence” occurs. The indication’s line is relocating a different instructions than the rate. It’s diverging away from it. This creates a signal to purchase. Bearish divergence is the very same idea. Rather of forecasting a buy point, it tells you that the present up-trend is coming to an end. This is a great place to leave a trade.

In our trading group, a few of our traders have been using this strategy really successfully. This is a longer term trade, generally lasting a week or 2, and takes patience to establish, persistence while in the trade, and knowing when to leave the trade. The charts are there to help you. Delighted trading.

I have actually always stated that it is not about market knowledge or technical indications. The distance from the top of the channel to the bottom must represent a variety sufficient to be traded.

If you are searching best ever entertaining reviews about MACD Crossover Above Zero Line, and Forex Market, Technical Indicators DM, Forex Alerts, Forex Analysis please list your email address in email alerts service now.