Price Action Multiple Time Frames How To Find Entry Points Using Multiple Time Frame Analysis

Latest overview relevant with Stock Signals, Currency Trading, Trading Rate, Forex Seminar, and Macd Multi Time Frame, Price Action Multiple Time Frames How To Find Entry Points Using Multiple Time Frame Analysis.

Price Action Multiple Time Frames How To Find Entry Points Using Multiple Time Frame Analysis

Fundamental Analysis?

Download Profitable Strategy Trading System For Mt4

https://www.mediafire.com/file/g5qgoh7x1o2xp4k/New_foldervvvvv.rar/file

https://www.forexfactory.com/

Most Powerful Japanese Candlestick Patterns in Forex Trading|Support and Resistance — Trend Analysis

What Is Support And Resistance?Use Trend Lines in Forex|Best Fibonacci Retracement Strategy Tutorial

What Is Forex Risk Management?

Forex Compounding Strategy: The Secret To Forex Trading Success

How to Use Triangle Flags and Pennants Price Pattern

How to Trade the Cup and Handle Chart Pattern – The Balance

How to Trade the Head and Shoulders Pattern –

How to Trade Double Tops and Double Bottoms in Forex Reversal Patterns

How to Use Moving Average Convergence / Divergence (MACD)Best MACD trading strategies

How to Use Relative Strength Index Formula | RSI Trading Strategy | Best RSI Setting for Day Trading

Most Popular Exponential Moving Averages Foex Trading Strategy|Exponential moving average formula

The Alligator Strategy – How to Use the Alligator in Best Forex Trading Strategy

forex time frames pdf

forex time frame analysis

forex time frame cheat sheet

best time frame for forex trading

trading 1 hour time frame forex

trading 3 time frames pdf

higher time frame trading

best time frame for day trading forex

forex time frames pdf

forex time frames meaning

swing trading forex time frames

most popular forex time frames

forex market time frames

how to trade higher time frames in forex

how to trade forex using multiple time frames

how to trade multiple time frames forex

forex higher time frames

how to read forex time frames

forex trading time frames

forex day trading time frames

forex trading lower time frames

forex trading multiple time frames

forex chart time frames

multiple time frame trading,multiple time frames,multiple time frame support and resistance,multiple time frame price action,multiple time frame analysis,multiple time frames for beginners,multiple time frames explained,top down analysis,top down analysis forex step by step,top down analysis forex,top down analysis price action,top down analysis smart money,top down analysis forex scalping,top down analysis supply and demand

Macd Multi Time Frame, Price Action Multiple Time Frames How To Find Entry Points Using Multiple Time Frame Analysis.

Average Directional Index (Adx) – Can It Be Used To Trade Forex Successfully?

There are a lot of forex indicators based upon trend. Likewise verify you indicate when the MACD pie chart is above the 0 line; signaling upward momentum. Volume – One of the very best signs of the conviction of traders.

Price Action Multiple Time Frames How To Find Entry Points Using Multiple Time Frame Analysis, Explore most shared full length videos about Macd Multi Time Frame.

Forex Trading – Swing Trading In 3 Basic Steps For Huge Profits

Although hindsight is 20/20, there’s still a lot to be learned by looking back at Forex trading. The technical analysis must also be figured out by the Forex trader. The vertical axis is plotted on a scale from 0% to 100%.

However one of the easiest to utilize is the pivot point when you discover about forex trading there are numerous technical tools to master. Pivot points deal with support and resistance levels to provide you an indication of entry and exit points for your foreign exchange trades.

I have always stated that it is not about market knowledge or technical indications. A great trader learns how to control his/her feelings by developing an individualized Macd Trading plan. A good trade is one gotten in and exited based upon guidelines and conditions – despite the outcome. Until a trader finds out how to manage their emotions and make sound trading decisions based upon guidelines, they are destined make the very same portfolio killing decisions of follow the most current guru. There is no success there. That guru will not be the one to position the trade for you. You MUST discover how to pull the trigger yourself.

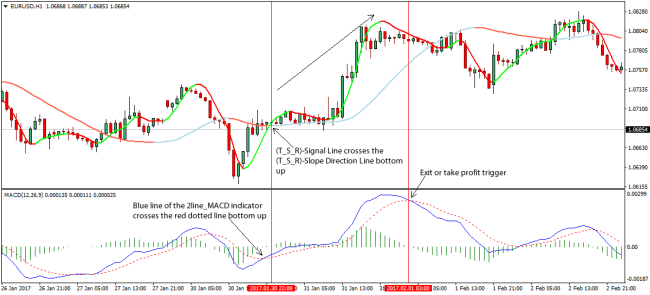

Notification the verifying signs: EMA 4 crossed LMA 10 upward on up trend is recommended and sensible of accomplishing your target everyday i.e. both moving averages crossed LMA 120, then set your Stop Loss 10pips listed below the LMA 120 or look for the swing low. Likewise validate you indicate when the Macd Trading signals histogram is above the 0 line; signaling upward momentum.

Several of our traders think that there are great assistance levels at 1.8650 and 1.8600. They have legitimate reasons to believe this, however they do not satisfy our requirements of entering trades.

Macd Trading Crossover (Moving Typical Convergence/ Divergence). This indication is generally a somewhat more advanced moving average. Rather of determining price information according to some approximate length, the MACD indicator takes the difference between 2 moving averages and then plots the changes graphically in bar chart form. What you are entrusted is a sort of roller coaster effect which charts the flows and recedes of price as it patterns upward or downward.

Pattern traders never ever fix a profit target. They recognize that there is no other way to understand ahead of time when a pattern will end, so they stick with the trend all the method. When it ends and reverses, “then” they leave the trade.

What you wish to do is desire for “resume and retrace”. What that implies is that you need to see MACD in the exact same location as the pattern. Wait for it to swing to the opposite side of the 0 line and then both main and signal lines to return back.

SURPRISE SECRETS: An additional advantage for traders technically is when there is no major news impacting the marketplace. You will constantly see a clear trend for the day. When trading utilizing technical indications, make sure you understand when the news is going to be launched so that you can position yourself. i.e. close your trade 10 to 15 minutes prior to the (FA) news. Then 15 minutes after the (FA) news, you could trade.

Which ever ones you choose, don’t use to lots of, a couple suffices. You need to practice this for numerous hours until you get consistent at selecting out winning trades. That master will not be the one to place the trade for you.

If you are finding more exciting videos related to Macd Multi Time Frame, and Forex Swing Trading, New Technical Traders, Trend Trade, Momentum Forex Trading Strategy dont forget to subscribe our email subscription DB totally free.