Unlock Explosive Profits: Master the MACD Indicator for Winning Trades!

Top videos related to Currency Trading Tutorial, Forex Trading Course, Determine Trend, and How to Avoid Macd False Signals, Unlock Explosive Profits: Master the MACD Indicator for Winning Trades!.

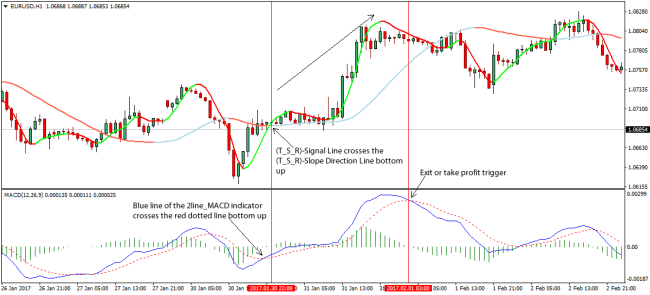

By taking this course, traders will thoroughly comprehend how to effectively use the Moving Average Convergence & Divergence (MACD) indicator to identify trend changes, momentum, and potential trading opportunities. Additionally, this course will cover a range of practical applications of the MACD in trading, giving traders the skills and knowledge to develop and implement potential trading strategies.

Attendees will learn to interpret MACD signals and use them to make informed trading decisions. They will also learn how to customize MACD to suit their trading style and gain a deeper insight into market volatility.

Please subscribe and comment @@InvestorsTradingAcademy

How to Avoid Macd False Signals, Unlock Explosive Profits: Master the MACD Indicator for Winning Trades!.

Swing Trading Forex – A Simple And Simple To Comprehend Technique For Big Gains!

Automatically renews every 90 days from subscription date. A great guideline is to look for a threat: benefit ratio to be a minimum of 1:2. This is typically where you need to leave the trade.

Unlock Explosive Profits: Master the MACD Indicator for Winning Trades!, Search top full videos related to How to Avoid Macd False Signals.

Discover To Trade Forex Without Signs – The Way The Pros Do It

What ever number of lots you choose to trade – divide that into thirds. This simply goes to reveal you that various trading designs exist, and a number of them work. Here is an example of a standard trading system.

At the very same time, I believe a great deal of traders try to under streamline too reaction to all the over issue. I’ve become aware of traders that don’t use any signs and simply look at price and take trades. Believe me, there are some who have the experience to do that. 99.99% possibility that you’re not one of them.

Time-sensitive trades: This comes in 2 kinds: To start with, in opening range breakouts, where a quick scalp is taken minutes prior to the open, in the instructions of any market thrust. I exposed a crucial trick in the previous edition of SDE on the best Macd Trading time for the EMA 4/12/63. Meanwhile, if care is not taken, the bull back preceding the breakout of the 7:45 am Nigeria time might strike your stop loss. However you can completely study the market; and scalp to make revenues before the primary breakout. And I will encourage you always utilize your Bollinger Bands, ideally on a different 15mins chart.

Reliable and typical way to find new patterns. When going with this approach, macd and moving averages are amongst the more utilized technical forex signs that are made utilized of. There are a great deal of services offered out there that supply you with pin-point entry cost and exit rate, be it forex day Macd Trading signals signals or a swing signals. However to understand which are the much better ones, it is advisable to browse for some forex system examines, so that you will not enter into a pirate ship.

Developing an effective forex strategy also depends on a particular person. Depending upon one’s requirements and goals, the technique can be followed. The primary and very first element is time. If just half an hour in front of the screen is adequate or long hours would assist one decide, one needs to decide. Likewise this depends upon the comfort level of the specific with the charts.

With your recently produced Macd Trading Crossover formula, let us see it in action. Use your preferred paper trading software application, recognize trading chances that fit your strategy, and place your trades diligently.

Additionally, there are a great deal of trading tools and indications such as EMA (Rapid Moving Typical), SMA (Simple Moving Average), MACD and others. But one can not constantly depend on the tools to get the fastest forex signals.

Why I say these 2 indicators are the finest for you. Let me describe. Trending conditions in the market exist not more than 30-40% of the time. Rest of the time, the marketplace is range bound or what you call consolidating. After a great trending relocation, the market will move in a combination stage.

Always validate the trading signals offered by the pie chart with the price action. If the rates and the histogram make new highs or new lows together, it means the price action will continue to relocate the same instructions.

If it is less than 20, the marketplace is ranging highly and if it is above 30, the marketplace is trending highly. One design all by itself has the possibility to be wrong. When was the last time you really spent time with your pair?

If you are searching updated and engaging comparisons related to How to Avoid Macd False Signals, and Stock Signals, FX Swing Trading dont forget to join for email list totally free.